Loan providers like to see as possible create month-to-month home loan repayments and won’t standard towards the loan. Regarding, they have https://paydayloansconnecticut.com/glastonbury-center/ been seeking monetary balances. This can be presented with a good credit rating, discounts, capital membership and you will several earnings streams.

When you’re care about-working, your work records to possess home financing may not meet very lenders. Alternatively, you might high light most other earnings avenues, such as self-employed functions, local rental income and you can financing earnings, proving total financial stability.

4. Improve your Offers

A stronger checking account can help demonstrate obligations and you may financial obligations, mitigating the possibility of inconsistent a position. When you’re there is absolutely no wonders matter, if you possibly could inform you substantial offers, equal to you to definitely three years or maybe more regarding mortgage payments, it could be more straightforward to safer a mortgage with below 1 year regarding functions record.

When underwriters glance at business records for a mortgage, employment gaps is actually red flags, however with preparing, you can navigate all of them. As prospective lenders will likely ask about holes on your a job background, you need to possess a coherent factor ready.

If you were unemployed due to infection, injury or any other products, be ready to give paperwork to help with their tale. If you were volunteering, delivering a year abroad or any other pastime, become it on your a position history to help fill in every holes – and to be certain all of them that you’re not believe one again.

six. Provide a strong Credit rating

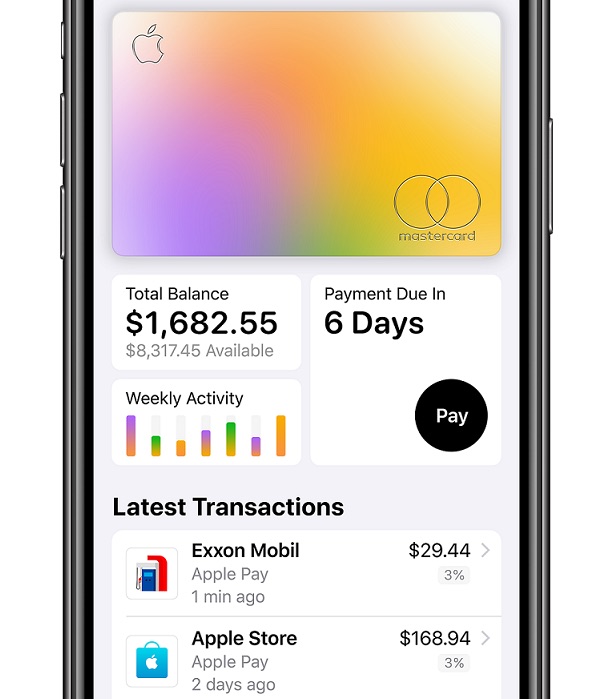

You to metric finance companies glance at whenever researching mortgage applications is actually a borrower’s credit score. While making to the-time payments and reducing their borrowing usage can enhance their get and increase the chances of acceptance. Choose a credit rating of 740 or above to increase your odds of recognition.

Just remember that , you can access your credit report within annualcreditreport so you can pick for which you currently stand and to make sure all of the details about the credit declaration is correct. Consider using a lease revealing providers so you’re able to post on-date leasing and you can tools money to improve your credit rating smaller. Are an authorized affiliate on the good pal’s or family relations member’s borrowing from the bank credit may boost your credit score – as long as its credit rating otherwise credit score is significantly best.

7. Demand a mortgage broker

Professional mortgage brokers is hook your which have a suitable bank mainly based on the financial situation. He’s got relationships with lots of loan providers, which could make the whole process of bringing a home loan much more obtainable and you will convenient. They’ll perform some of the browse and you will become an enthusiastic advocate on your behalf from the home loan app procedure, even in place of many years on your industry to simply help get property financing.

8. Be ready to Give Extra Records

When you’re wanted more documentation during the mortgage application procedure, think about it a sign. He or she is prepared to evaluate the application but may inquire about bank comments and other financial comments, tax statements and employment details to display qualification. To get rid of delays otherwise denials, be sure things are under control prior to the application.

9. Imagine Co-Individuals

In the event your a career records might possibly be best, while are unable to have shown a robust financial case with a high credit history, big downpayment and you will savings, think introducing good co-applicant with a more consistent work checklist. Brand new co-applicant doesn’t need to getting a great co-holder of the house, merely an excellent co-signer on the mortgage to help with the job which help your qualify.

10. Usually do not Call it quits

Even though you may have fewer decades into the a profession, a mortgage actually out-of-reach. Show patience and chronic, and you will explore the choices very carefully to find the home loan you want. A mortgage broker or co-signer is discover gates.