In addition, a business that needs to invest its resources in a project without knowing the risks and returns engaged in will be considered irresponsible by its owners or shareholders. Capital budgeting describes the process which companies use to make decisions on capital projects, i.e., projects whose lifespans can either be one year or more than one year. It is a cost-benefit where does your tax money go exercise that seeks to produce results and benefits which are greater than the costs of the capital budgeting efforts. For companies operating in multiple countries, fluctuations in currency exchange rates can significantly impact the value of investments. Changes in exchange rates can transform a profitable project into a loss-making one, and vice versa.

Initial Project Evaluation

Capital budgeting is the process whereby a company decides its major, long-term investments such as purchasing property, buildings or equipment, or merging with or acquiring another company. These decisions are crucial as they dictate the company’s future earnings and financial health. The process considers factors like development timelines, success probabilities, market potential, and competitive advantages while assessing the strategic value of innovation investments. The process helps analyze location benefits, capacity requirements, and potential revenue increases while considering factors like market demand, workforce availability, and regulatory requirements. The process considers research and development expenses, marketing costs, production requirements, and competitive factors while assessing the product’s potential success and alignment with market demands. This enables better planning for resource needs, helps prevent cash flow shortages, and ensures projects maintain adequate funding throughout implementation phases.

- Capital budgeting is concerned with identifying the capital investment requirements of the business (e.g., acquisition of machinery or buildings).

- As part of capital budgeting, a company might assess a prospective project’s lifetime cash inflows and outflows to determine whether the potential returns it would generate meet a sufficient target benchmark.

- Volopay’s controls help prevent unauthorized expenses, ensure compliance with budget allocation, and maintain proper oversight while providing flexibility to adjust rules based on project requirements.

- Develop systematic approaches to determining discount rates that reflect project-specific risks and market conditions.

- In taking on a project, the company involves itself in a financial commitment and does so on a long-term basis, which may affect future projects.

- Therefore, capital budgeting is an essential tool in the ongoing evaluation and enhancement of a company’s fiscal performance.

Determine the Feasibility of the Project

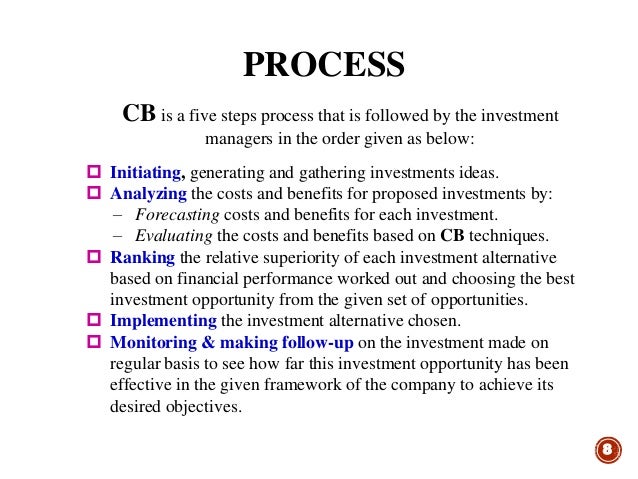

The process of capital budgeting follows a structured approach that helps organizations make informed investment decisions. The net present value (NPV) method evaluates the value created or destroyed by a capital investment by accounting for all marginal benefits and costs. Marginal benefits are the future cash flows from the investment, while costs include upfront, future and opportunity costs. The net present value approach is the most intuitive and accurate valuation approach to capital budgeting problems.

Do you own a business?

Though companies are not required to prepare capital budgets, they are an integral part in planning and the long-term success of companies. Some of the major advantages of the NPV approach include its overall usefulness and that the NPV provides a direct measure of added profitability. The primary advantage of implementing the internal rate of return as a decision-making tool is that it provides a benchmark figure for every project that can be assessed in reference to a company’s capital structure. The IRR will usually produce the same types of decisions as net present value models and allows firms to compare projects based on returns on invested capital. Since the payback period does not reflect the added value of a capital budgeting decision, it is usually considered the least relevant valuation approach.

The central CapEx controller should then be able to accept or reject these submissions and iterate an investment proposal and reallocate budget between areas until an enterprise capital budget is determined. This interaction between area managers and the CapEx controller should be fully digital, and based on a single source of truth at all times. Despite the need for the capital budgeting system to offer sophisticated portfolio recommendations, responsibility should remain with area managers to optimize their capital budget allocation. Only area managers have the experience and judgment to fine-tune portfolio selections. All organizations make a high volume of direct capital purchases, including vehicles and equipment.

Compliance systems ensure regulatory adherence

The process helps evaluate potential mergers and acquisitions by analyzing purchase prices, integration costs, and expected synergies. Capital budgeting guides market entry decisions by evaluating setup costs, market potential, and competitive dynamics. The process evaluates construction expenses, maintenance requirements, and operational improvements while considering factors like regulatory compliance, environmental impact, and future expansion possibilities. Capital budgeting supports decisions about equipment upgrades by comparing the costs of new equipment with potential productivity gains and maintenance savings. The process provides structured approaches for articulating project benefits and expected returns to various stakeholders. This evaluation process identifies potential challenges early, validates assumptions, and ensures projects have realistic chances of success before significant resources are committed.

Due to the effort required to manually collect and present forecasts, for example, there is typically a delay in their preparation and presentation. The longer it takes to get information, the less time we have to take mitigating actions, and the greater the risk of over-spend on failing projects. In other words, the IRR is the discount rate that makes the present values of a project’s estimated cash inflows equal to the present value of the project’s estimated cash outflows. In other words, the NPV is the difference between the present value of cash inflows of a project and the initial cost of the project.

Without ongoing sustenance of the capital base required to support your business-as-usual activities, there is a risk of failure or obsolescence of current assets impacting successful ongoing operations. In summary, capital budgeting aids in the efficient allocation of resources during M&A by providing a robust financial model for assessing potential investments and their financial viability. For instance, funds can be dedicated towards projects aimed at reducing greenhouse gas emissions, improving working conditions, or reinforcing corporate governance structures. These capital budgeting decisions will not only serve to satisfy ESG criteria, but can also enhance company reputation and foster greater investor confidence.

Research and development investments are evaluated through capital budgeting by analyzing potential returns against uncertain outcomes. Infrastructure development decisions benefit from capital budgeting through a comprehensive analysis of long-term costs and benefits. This openness helps build trust, ensures decisions are well-understood across the organization, and creates clear accountability for project outcomes while maintaining strong organizational support for investment decisions. This understanding enables more effective resource allocation, ensures realistic project planning, and helps identify potential synergies or conflicts in resource utilization across multiple projects. Involving key stakeholders in the project evaluation process helps ensure that selected investments align with broader organizational objectives.

Organizations should monitor actual versus projected IRR, establish minimum acceptable rates based on the cost of capital, and regularly assess whether projects maintain required return levels throughout implementation. Many organizations face challenges with implementing complex techniques correctly, particularly when dealing with unusual cash flow patterns or projects with significant strategic options and flexibility. Precise revenue projections require comprehensive market analysis, historical data evaluation, and consideration of future market conditions. Organizations must account for pricing strategies, market share expectations, and potential changes in customer behavior when estimating future income streams.