The rate of interest increases over the past two years enjoys delivered a critical facts glance at, making variable speed home loans greater than they’re getting a age group.

Which means you would like to get your house financing being employed as tough that you can particularly when your own repaired rate financing is about to get to the stop of its title and you are clearly up against a rapid escalation in repayments.

Thank goodness there are methods you could build your property loan to expend reduced demand for the near future and take many years regarding the mortgage.

step 1. Set-up a counterbalance membership

For many who have not already, verify that you might link a counterbalance put account to your home loan. A counterbalance membership operates such as for example a deal account, nevertheless reduces the interest you only pay as the notice is only energized to the mortgage equilibrium reduced the brand new counterbalance harmony.

You can join up so you can 10 offset put accounts to every adjustable Amplifier mortgage that you have. You might developed counterbalance makes up about big-ticket things such as vacations, a vehicle purchase otherwise home improvements otherwise casual necessities such shopping and you will expense.

The latest combined equilibrium of all of the your counterbalance put account wil dramatically reduce the attention payable in your financing. You may also hook up a visa debit credit to your offset membership one operates such as a frequent membership and makes it simple to withdraw the funds loan places Ridgeville.

If you have an amplifier home loan, you could apply for a counterbalance membership within just five times just complete this type.

dos. Take advantage of their redraw business

Amp varying lenders render a beneficial redraw studio to get into even more money you could have generated. If you have unforeseen costs, it is value checking when you yourself have offered money on your property loan that you may possibly consult so you can redraw. You can easily only have to remember this you’ll increase living off your loan so you finish expenses much more interest in the brand new long run.

When you have an amplifier financial, you can demand a redraw through the My personal Amp mobile application otherwise on the internet financial from your desktop computer.

3. Combine most other debt into the financial

It is possible to fundamentally discover rate of interest on your own home loan is below the attention on the handmade cards or unsecured loans. So if you have any financial obligation, you could transfer this to your residence loan and that means you don’t pay as often full interest.

cuatro. Replace your cost count

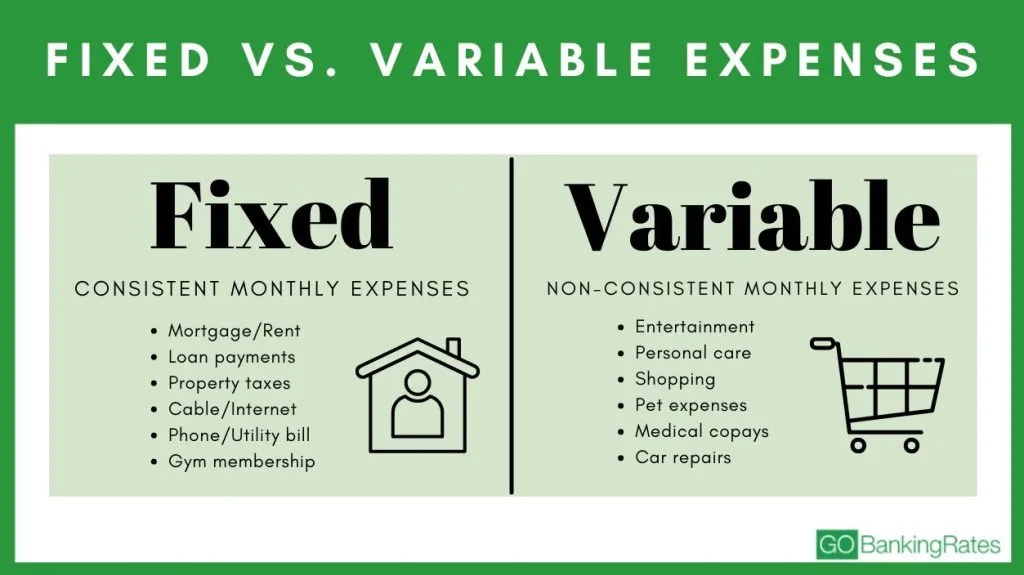

Doing a spending plan may help you mix just how much earnings you may have to arrive, simply how much you prefer to the tips and where in fact the other people of one’s money might possibly be heading. This should help you pick if there is any area to own way whenever you might pay off some extra. AMP’s Budget coordinator calculator could help you crisis the latest quantity.

5. Alter your cost frequency

Purchasing fortnightly in lieu of month-to-month, like, can make an improvement to the desire you pay from inside the the near future.

6. Replace your money in order to dominating and focus

While making dominating and interest (P&I) money decrease your the loan balance and lower the quantity interesting you’ll spend across the lifetime of the mortgage. But do not skip switching to P&I can increase your typical payments.

seven. Renegotiate the rate of interest

When you see a reduced rates that have a separate provider, lose you a column therefore might be able to let that have a far greater deal.

8. Believe whether to refinance

Whenever you are with cashflow demands, you could think about refinancing to reduce your repayments. But bear in mind this could imply extending the loan term.

We offer a range of lenders with assorted enjoys and positives there is something for everybody. Mention our house money on the web or publication a trip having you to definitely of your family lending experts now.