To buy property will be an elaborate processes, specifically for basic-time consumers who will be just discovering the latest ropes. However, one thing that doesn’t have to be overly difficult is actually a great Virtual assistant mortgage. Available for pros, these types of mortgages will likely be a lot-particularly for consumers who will be unable to help save for an all the way down payment.

While implementing using your lender, the fresh new digital program you will confirm qualifications in minutes-however if you will be implementing from the mail, bear in mind the process might take a bit

So that you can confidently prepare toward process in the future and determine if the a beneficial Virtual assistant mortgage is right for you, let’s walk through probably the most are not expected inquiries and circumstances you may not know about the program.

This new U.S. Service off Veterans Affairs (VA) makes it much simpler to possess veterans and you may latest members of the brand new military to cover a house. Demanding no advance payment and no private financial insurance rates, these money can cut each other your right up-side will set you back and payment can cost you.

Very traditional mortgage loans would like you to get off a hefty 20 per cent down-payment. If you fail to afford the down payment, you will have to pay individual home loan insurance policies (PMI) near the top of your own monthly mortgage payment-a supplementary fee to be certain your financial becomes repaid although you simply cannot help make your money. In the scenario out of an effective Va mortgage, the loan is actually guaranteed by the U.S. authorities, which means lenders do not require this type of important charges. Additionally, a great Virtual assistant home loan provides you with the benefit of to stop prepayment charges.

Of a lot latest and you may former members of brand new army-and additionally reservists and you may Federal Shield participants-meet the criteria to apply for a good Virtual assistant mortgage. In some conditions, surviving partners can certainly be eligible. You will need to fulfill certain service standards-ranging from 90 days to help you half dozen decades, based version of provider. Consult with the fresh new Institution out of Experts Facts having over qualifications requirements.

Whenever you are eligible, you’ll need to score a certificate out-of Qualification (COE), which verifies their armed forces solution, to try to get an excellent Va mortgage loan regarding a loan provider. You might use online, from post, otherwise possibly throughout your lender.

Aside from the necessity to prove your armed forces service that have a beneficial COE, the whole process of trying to get a beneficial Va mortgage is a lot such as the techniques getting making an application for a traditional financial. Your financial institution often review your borrowing-seeking to see if you really have good credit therefore the element and make monthly premiums.

Va mortgages provides certain eligibility standards that really must be satisfied and program certain forms to complete in advance of making an application for an excellent Va home loan

not, even if you qualify for a Va real estate loan, a loan provider can invariably propose to change your down because of poor credit. As with any major financing, it usually is best to make sure your borrowing from the bank is in a shape before applying.

Sure. Necessary for rules, new Virtual assistant Home loan program really does fees a right up-front side Va financing payment. The price tag selections from just one.25 % to three.step three percent depending on next standards:

Just how much from a down payment you can use make (down repayments more than 10 percent get the low rates)

The fresh new Va money percentage shall be pretty high, but it’s way less than simply you’ll significance of a lower fee, therefore provides their payment reduced since you wouldn’t shell out to possess PMI. Handicapped veterans in addition to their surviving spouses are generally exempt of financial support charges, so it’s even easier to allow them to enter property. Check https://paydayloanalabama.com/jackson/ with the fresh new Virtual assistant getting complete speed facts.

Outside of the Va funding commission, you’ll have the fresh new settlement costs of a timeless home loan. Such costs could potentially include: assessment, identity insurance policies, credit history, taxes, and you may dismiss items.

Like most home loan, you’ll pay mortgage loan lay by bank, as well as homeowners insurance and you may taxes-aforementioned at which tends to be rolling in the monthly payment and put to your an escrow account. Without the need for a deposit, you’ll pay reduced up-side, however, providing a good Va real estate loan isn’t free, even although you meet the requirements to have the investment percentage waived.

There are many constraints as to what you can get that have a beneficial Va home loan, but for most homeowners this should never be a challenge. You can use the loan to get a property (or multi-equipment possessions), build property, refinance your existing home loan (should it be a Virtual assistant or non-Va mortgage), or purchase a produced home.

Regardless of the sort of house you happen to be to purchase, Virtual assistant mortgage loans are merely to suit your top house. You simply cannot fool around with a beneficial Virtual assistant home loan to find a holiday house, next family, or money spent. not, if you transfer to a special house, however, intend to keep your Va real estate loan-bought assets because the a rental, your generally speaking can be-providing you you should never get it done quickly. Check with your financial to be certain.

Yes. However, you ought to fully repay one mortgage before you can make an application for a different. Just remember that , the fresh Virtual assistant money commission to possess then Va mortgages is large-however it is however probably be a good deal having consumers exactly who dont carry out a 20 percent down payment.

For the majority of individuals, sure. The blend out of no advance payment and no PMI renders good Va mortgage loan an interesting method of getting into a home without big upwards-front can cost you. But not, it isn’t always a good deal for everybody. If you possess the deals and then make a 20% down percentage with the a property, you would not have to pay PMI to begin with-just in case that is the instance, the newest Virtual assistant resource payment was an extra cost. In this instance, a classic mortgage is probably as a far greater buy.

Before race to your generate a last decision, work with the fresh quantity. Take the time to compare prices plus the costs associated with more conventional mortgage loans in place of a beneficial Va financial with your financial-eg PenFed. Following decide which variety of mortgage is best for your.

Brand new Virtual assistant by itself does not render mortgage resource to possess mortgages. Just be sure to acquire right from your financial otherwise borrowing from the bank union. Check with your standard bank observe whether they provide Virtual assistant mortgage loans.

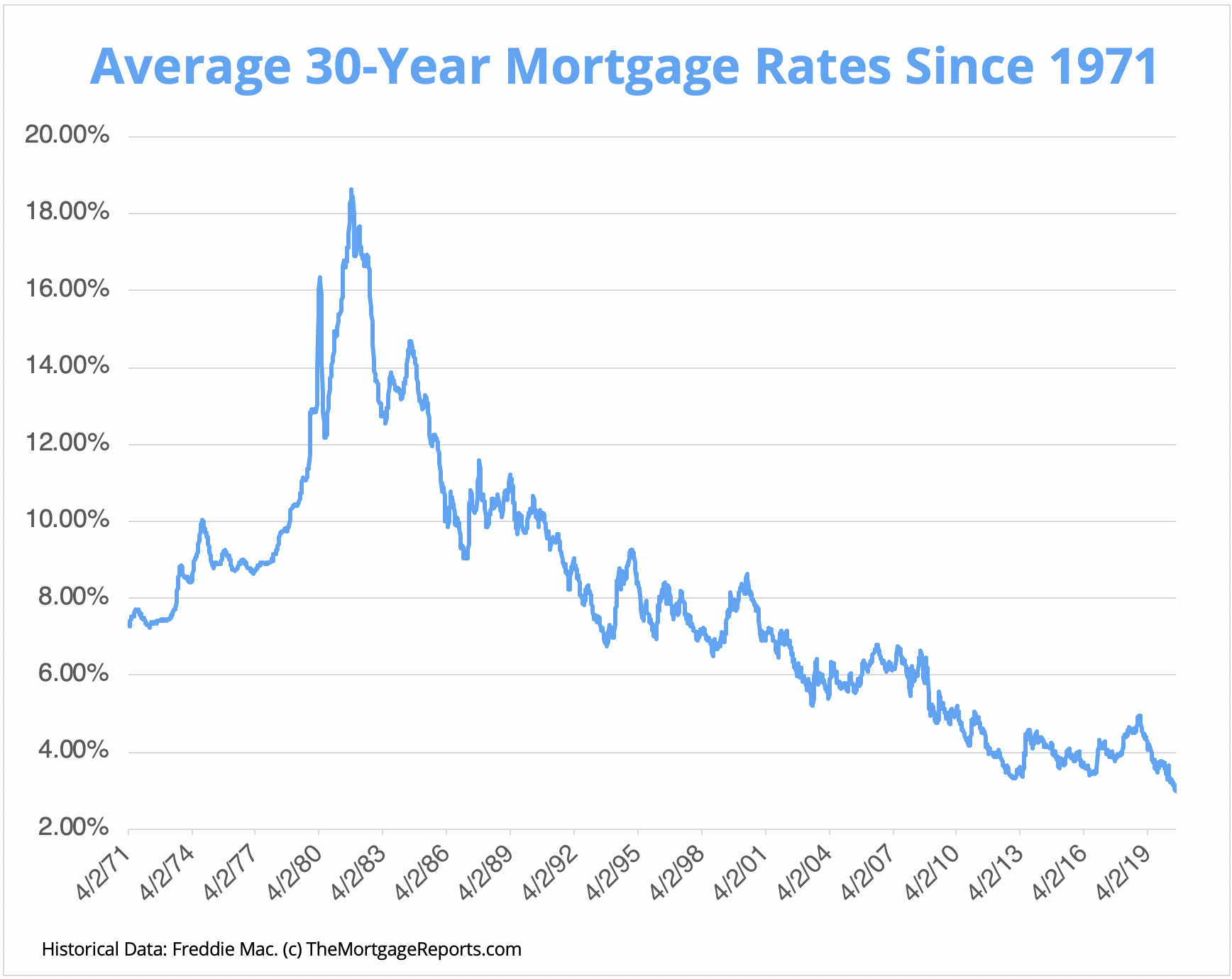

PenFed, instance, also offers each other fifteen-year and you can 31-year Virtual assistant Fixed Mortgages. That have rates out-of 2.625% Annual percentage rate to 3.375% APR*, PenFed may help get you for the an alternate household at the a great realistic rates.

*Rates and will be offering can be found in effect by for new applications only, to own a small day, and susceptible to alter without notice.