Non-expectation Condition: A statement when you look at the a home loan package forbidding the belief of your financial without having any previous acceptance of your bank.

Holder Money: A home pick deal in which the group attempting to sell the house or property provides all of the or area of the money.

Fee Transform Time: The fresh new day when an alternative monthly payment count takes influence on a varying-price financial or a finished-percentage home loan. Fundamentally, the newest payment changes go out happens in the latest few days shortly after brand new variations day.

Occasional Price Limit: A limit with the number that the interest can increase otherwise drop off while in the anyone improvement months, in spite of how large or reduced the brand new index could be.

Pledged-account Mortgage(PAM): Cash is placed in a sworn savings account hence finance plus made focus was slowly used to get rid of mortgage payments.

Note: A legal document one to obligates a debtor to settle a home loan loan from the a reported interest while in the a selected period of go out

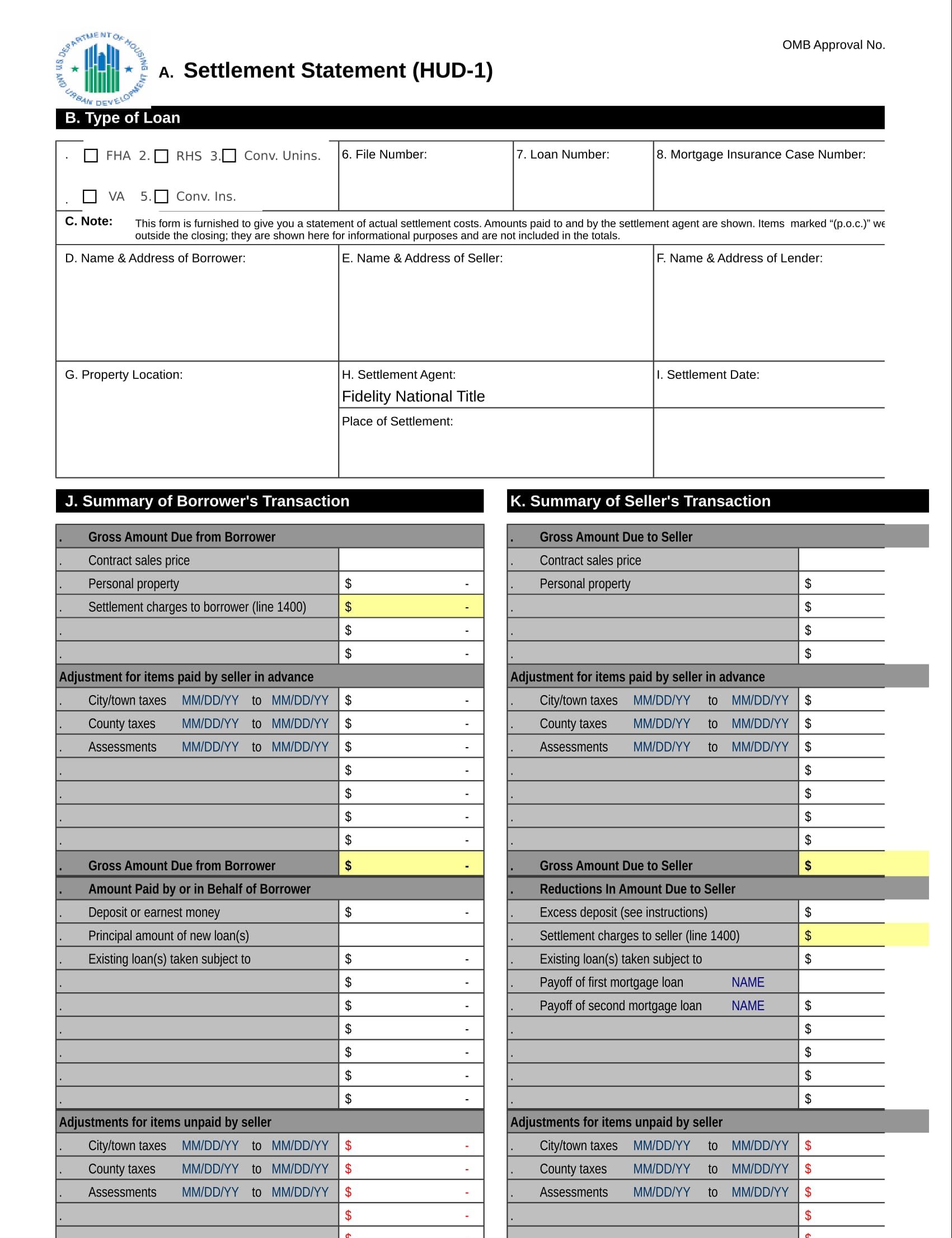

Points: One point means 1 percent of the financial number. Activities was recharged by the loan providers to increase the lender?s come back towards the home loan. Typically, lenders may charge any where from no so you can one or two facts. Loan issues was tax-deductible. Electricity of Attorney: A legal file authorizing one person to behave on the part of an alternative. Pre-approval: The whole process of deciding how much money you might be eligible in order to acquire before you apply for a loan.

Tape Charge: Currency paid back into financial to possess tape a property income with your regional government, and so it is therefore a portion of the public record information

Prepaid service Expenses: Had a need to manage an escrow account or perhaps to to evolve the vendor?s current escrow account. Range from taxes, possibilities insurance coverage, individual home loan insurance rates and you can special assessments.

Prepayment Punishment: Currency billed getting a young cost out of loans. Prepayment penalties are allowed in a few setting ( not necessarily imposed) in lot of claims.

Primary Mortgage Industry: Loan providers, particularly offers-and-mortgage connectivity, commercial financial institutions and you can mortgage people, exactly who generate mortgage loans straight to borrowers. These businesses possibly offer its mortgage loans on secondary financial locations.

Principal: The borrowed funds loan amount or nevertheless owed. Personal Home loan Insurance coverage (PMI): Insurance given because of the personal insurance companies you to covers lenders facing a loss of profits if a borrower non-payments toward a mortgage which have a reduced down-payment (elizabeth.g., less than 20%).

Q Qualifying Percentages: Data accustomed know if a debtor normally be eligible for an effective mortgage. It incorporate a few independent calculations: a construction bills as the a percentage of money ratio and overall debt burden as a per cent cash proportion.

Roentgen Rates Secure: A partnership issued from the a loan provider in order to a borrower and other mortgage inventor promising a selected rate of interest and you may bank costs for a designated time. A house Payment Methods Act (RESPA): A customers shelter rules that requires lenders to give consumers improve observe out of closing costs. RESPA is actually a federal rules one, on top of other things, lets consumers to examine information about understood otherwise estimated settlement rates immediately following application and you may just before or at payment. Regulations needs loan providers to help you furnish every piece of information once application merely. REALTOR: A bona-fide estate agent or broker who, because a member of an area organization out of Realtors, a state organization out of Realtors and web site also the National Organization Regarding Real estate professionals (link to onerealtorplace), adheres to higher requirements regarding professionalism and a strict code out-of ethics. Recission: The newest termination out of an agreement by putting every functions back again to the positioning prior to they inserted the fresh new contract. In a number of financial funding circumstances involving security home since protection, legislation offers the resident three days so you can terminate a contract.