*]:mt-0 [&_a]:text-blue [&_a]:underline cut off text message-md md:text-lg leading-regular min-h-[step 1.5em] font-regular [&>*]:last:mb-0″>When you find yourself looking for delivering financing, particularly a home loan, car loan, otherwise credit line, you should understand what your credit score try. After all, it’s your credit score that loan providers used to determine just who to help you loan their cash to and you may what pricing giving them. Generally speaking, the higher your credit rating, the much more likely you will end up to help you qualify for an effective financing.

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut-off text-5xl md:text-7xl leading-injury font-black recording-regular md:tracking-[-0.5px] mt-32″> Try a great 585 credit rating a beneficial otherwise crappy?

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut off text message-md md:text-lg leading-typical min-h-[1.5em] font-regular [&>*]:last:mb-0″>If you a beneficial 585 credit score, you might be wanting to know in the event that’s a beneficial score or a crappy get. Predicated on Equifax Canada, one of several nation’s a couple of significant credit bureaus (communities you to point fico scores), a good 585 credit rating drops inside the fair assortment.

*]:mt-0 [&_a]:text-blue [&_a]:underline stop text-4xl md:text-6xl best-wound font-black colored mt-32″> Credit ratings inside the Canada

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut off text message-md md:text-lg leading-typical minute-h-[step one.5em] font-typical [&>*]:last:mb-0″>Your credit score are good around three digit matter one ranges regarding 300 so you’re able to 900. Perhaps you have realized, there is an extensive variance as well as your rating relies on a number of situations. The brand new TLDR is the fact that high your own score, more credit-worthy you might be determined become by the credit agencies and you will, this is why, loan providers. A premier credit rating unlocks enough monetary solutions, such as for instance being qualified to own lesser loans, most useful likelihood of providing a position once the particular employers, such those who work in the new financial features field, consider individuals fico scores throughout the criminal record checks and you will a higher likelihood of qualifying to have a rental home.

*]:mt-0 [&_a]:text-bluish [&_a]:underline block text-md md:text-lg best-typical min-h-[step one.5em] font-regular [&>*]:last:mb-0″>The average credit rating within the Canada, predicated on TransUnion, try 650. If you have a credit score out of 650, meaning your fall following next the common credit score in Canada. A get out of 585 is definitely the reasonable rating some one can also be enjoys and have a good credit. Fortunately there are a great number of things you can do adjust your rating. On you to definitely during the sometime.

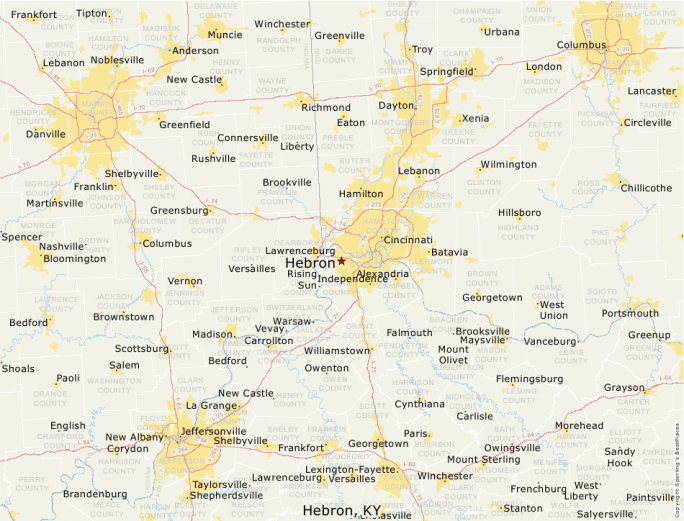

*]:mt-0 [&_a]:text-bluish [&_a]:underline block text message-md md:text-lg top-normal min-h-[step one.5em] font-normal [&>*]:last:mb-0″>Very first, even if, why don’t we take a closer look in the mediocre credit scores within the some of Canada’s biggest towns and cities.

*]:mt-0 [&_a]:text-blue [&_a]:underline cut off text message-md md:text-lg top-normal minute-h-[1.5em] font-typical [&>*]:last:mb-0″>As you can plainly see, an effective 585 credit rating is beneath the mediocre get within the each ones metropolitan areas. You can find reason why their get is generally fair rather of good, like other of them ratings.

*]:mt-0 [&_a]:text-bluish [&_a]:underline stop text-4xl md:text-6xl best-wound font-black colored mt-32″> Affairs one adversely effect your credit score

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut-off text message-md md:text-lg leading-typical min-h-[1.5em] font-regular [&>*]:last:mb-0″>There are many facts one to reduce your credit history over time. The credit bureaus gather information regarding for every single Canadian to enable them to dictate fico scores, and lots of of everything just one does can result in a good get to reduce. This consists of:

*]:mt-0 [&_a]:text-blue [&_a]:underline block text-md md:text-lg top-typical min-h-[step one.5em] font-regular [&>*]:last:mb-0″>This can be a big one. Failing woefully to build a loan loans Avondale CO fee, be it to possess a charge card or other financial obligation, can have a life threatening bad effect on your credit score. A substantial 35% of the credit score utilizes their ability to constantly see your loan loans. Hence, its crucial to scrutinize your credit score for your prior instances of skipped repayments. Because of the acknowledging these types of lapses and committing to punctuality throughout future money, you can gradually boost your credit score.