In the event the business allows Western Show playing cards and you may functions consistent debit and you can borrowing transactions, Western Share Supplier Capital might be an useful cure for build your company. A quick-title money alternative closely resembles a traditional provider pay day loan. Yet not, there are some famous variations, specifically away from conditions and fees solutions.

What’s Western Show Seller Capital?

Western Display Merchant Investment is largely a seller payday loans getting businesses that deal with American Show mastercard repayments. You might acquire doing $2 million, with regards to to 2 years. The debt is actually paid down thru a predetermined percentage of each and every day debit and you will credit card conversion process. Thus, the better the sales frequency, the greater you only pay that time. Arguably a new element out of Amex Provider Financial support is the fact costs may come from all borrowing and you may debit conversion process or simply just the transformation out of Western Show notes; This alone stands for a departure regarding equivalent apps of Paypal Working Investment, Square Capital, and you will Stripe Funding that simply receive money back regarding the section off costs canned thru men and women properties.

What exactly do You should Sign up for Western Express Seller Resource?

- Organization tax statements

- Providers bank statements

- Monthly comments out-of mastercard processors

- Income tax ID or American Express Credit card merchant account Matter

- Mastercard Processor chip Term and you will Matter

- Your Personal Defense Amount

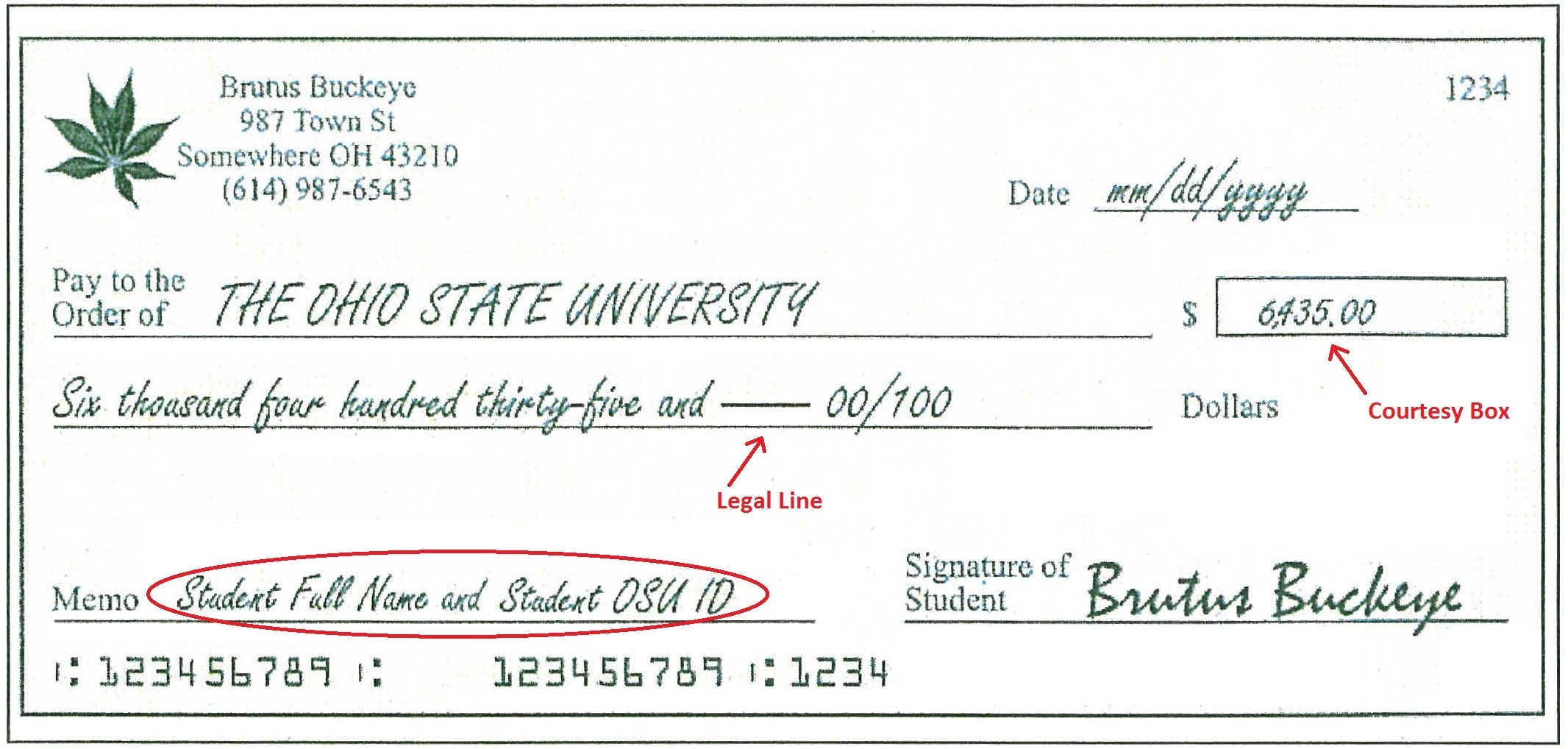

- Organization Bank account Facts (bank title, routing amount, and you will membership amount)

Almost every other Secrets to have Western Express Supplier Money

Western Display Merchant Funding is just available to companies that take on fee through Amex borrowing from the bank or debit notes. When you find yourself seeking a max title regarding 2 years (couple of years), your company have to have accepted Amex credit cards having a couple of years.

Eligible companies must generate at the very least $fifty,100000 within the annual money and $twelve,100 inside yearly borrowing or debit receivables. Your business should also feel at the very least 2 yrs old. And though Amex doesn’t have the very least credit score, most individuals reportedly possess scores of at the least 650.

In place of a classic supplier cash advance, Amex Supplier Funding needs guarantee. AMEX never explore home and you will motor vehicles (even the a couple of most well known forms of guarantee). Ergo, you are going to need to use almost every other providers assets such as for example products or collection.

Whenever you are seeking to lower than $35,100, you may need to indication a personal make sure. Consequently Amex might grab your very own assets to make up for the loss in the event of a standard.

Concurrently, Western Share cities limitations into certain marketplaces according to research by the latest amount of exposure. You will have to get in touch with a support user to see if the world falls under this community.

To own Western Express Seller Financial support, You must know That:

Amex Supplier Investment offers numerous installment expertise. Basic, you could have repayments deducted off every borrowing from the bank and debit credit conversion. In cases like this, Amex lovers along with other credit card companies so you can automatically subtract payments from the accounts together with them.

Next, it’s possible to have payments subtracted entirely from your own mastercard receivables resource that can come of Amex sales. Thus, you’d merely create money for the days whether your business can make Amex conversion. However, you ought to perform a specific amount of Amex transformation in order to be considered for it payment system.

An alternative choice is having others credit card companies send the receivables to help you Amex to allow them to subtract your payments from this bank account. Lastly, you could qualify for everyday ACH debits from your team bank membership. This is a relatively popular cure for process automated costs, particularly for home business finance.

As opposed to a timeless interest rate, Amex charges a fixed payment of 1.75% so you’re able to 20% of your full loan amount. Which comes out so you can as much as $0.06 to $0.twenty six on each money borrowed. This new offered your terminology, the higher your own commission.