The very last one year have experienced many changes and you can they drops towards the you because home loans to help you comply with new the newest land. I indeed didn’t that is amazing in many cases, commercial fund perform be less expensive than home-based investment loans!

APRA isn’t trying to make your life tough

As the you’re probably aware, all financial institutions made change to their attract only policy and you will prices on account of limitations applied by APRA. Because the mortgage brokers, i without a doubt don’t like with our possibilities restricted, or one extra complexity so you’re able to deciding on the best financing having an excellent consumer.

- Australian continent try dependent on appeal only loans, this might be a risk for both the financial institutions and you can all of our housing market.

- Pair individuals know exactly how much significantly more notice they spend with an interest just mortgage.

- There are various somebody and come up with interest simply repayments whether or not it is completely the incorrect to them.

Higher issues bring about high guidance

In the home Financing Positives weuse a number of effortless inquiries to decide if interest simply money was suitable for a client. Such as, you can pose a question to your users in addition to this vital that you him or her:

- Less rates or straight down payments?

- High borrowing energy or less speed?

- Want to reduce your money for a while?

When the a reduced speed or a high borrowing energy is more important to a customer, then they should probably end up being purchasing P&We.

Proprietor filled financing that have interest merely money

In most cases, it is an improper selection for extremely readers and you will merely consider this if there’s a very good reason to do this.

Such as for instance, at home Mortgage Positives we’d think attention simply for property loan if your visitors required payment self-reliance and their company cash-disperse, or if perhaps it desired to keep their funds on the standby inside an offset membership in case there is problems, or if it desired to purchase the excessive loans.

When they not economically higher level it is dangerous. These are generally impractical to profit regarding notice simply payments and you may potentially, they may not pay off their home mortgage whatsoever.

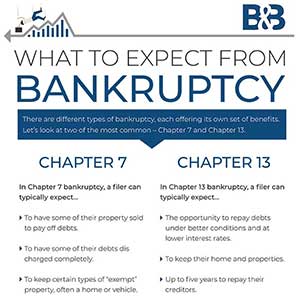

It is time to communicate with non-conforming loan providers

Yourself Financing Masters, we think funding finance is a variety of low-conforming financing. That isn’t to say that financial institutions do not carry out her or him. They have been not the brand new taste of times and also you you prefer to take on pro loan providers including major of these when you are probably meet the needs of your property buyer readers.

Precisely what do new numbers state?

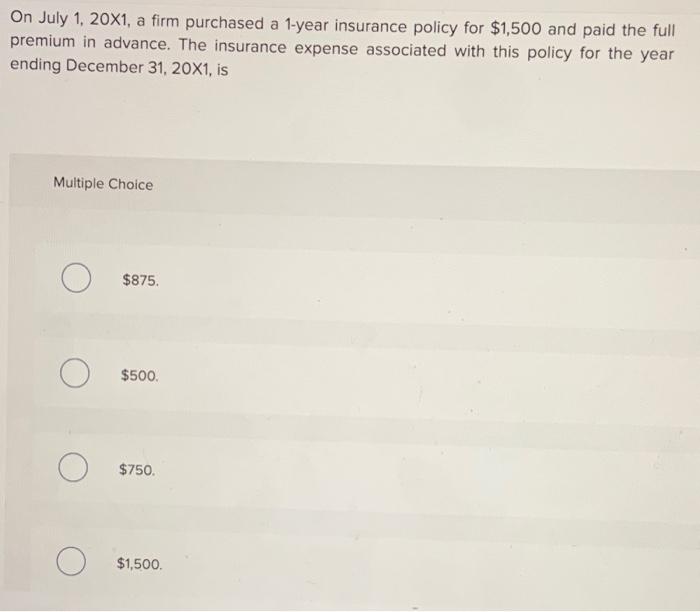

Can you imagine one of your people is actually determining ranging from a good $five hundred,100 resource loan at the 4.5% over 30 years, or financing from the 5% for five decades that have interest simply repayments reverting in order to 25 years in the cuatro.5% which have P&We costs.

To start with the brand new repayments is $dos,533 / week P&We compared to $dos,083 / month attention merely. So that the payments was 21% higher when they spend P&We. At the end of the eye simply months the fresh repayments carry out be $2,779 that’s nine% greater than the high quality P&We costs more 30 years. Couple customers are alert to that it and also fewer check out the impression this particular gets on their dollars-flow.

Investing P&I, the client tends to make full money out-of $912,034 whereas, that have an excellent 5 season notice merely months they’d spend $958,749. That’s an impressive $46,715 during the additional notice! Again couple customers are alert to exactly how much a lot more they costs her or him.

An effective guideline would be the fact an effective 5 seasons focus simply months costs a customers 11% so much more from inside the appeal along side name. That’s of course, if, needless to say, that they do not get another notice just period whenever its very first you to definitely ends.

What about credit energy? If an individual borrower that have an income out of $one hundred,100000 takes out a home loan, chances are they can be obtain as much as $620,100 that have P&I repayments or $585,one hundred thousand which have a beneficial 5 season focus simply period https://cashadvancecompass.com/loans/borrow-money-online-instantly/. It is far from a big bargain, only a great six% differences. Getting users that have numerous properties, it will have a much larger perception.

How about your users?

Should you decide refinance these to the lowest priced attention only loan offered if they are disappointed through its financial? Not likely. Varying pricing will likely be altered at any time, therefore what exactly is to avoid the newest bank putting its cost upwards?

That means it’s time to shell out P&We. Correspond with such clients about sometimes switching to good P&I financing, refinancing to some other financial that have P&I payments, or if they do have to spend attract merely, then restoring its price may be best.

From the Otto Dargan

Otto ‘s the Handling Manager from Mortgage Benefits and it has already been a person in Connective for more than ten years. Financial Pros features claimed Significant Brokerage of the year (Non-Franchise) and Otto provides double already been titled Australia’s Brightest Broker regarding Adviser’s Agent IQ Competition.