Anybody against tough economic moments often turn to funds given by the fresh new FHA or Government Property Government. These types of financing are this new gold liner for people experience bitter monetary adversity. Such fund are supplied with lots of gurus, particularly the low down money (minimal than simply step 3.5%). These types of flexible standards are given to borrowers with many credit challenges and lower profits. Other than pursuing the effortless advice required because of the FHA, the brand new belongings should suffice certain conditions to have small acceptance. On this page, we shall appeal more on our home and this does not fulfill new conditions out of an FHA financing, have a look at lower than:

Understanding the Principles

Very first anything first, we need to see the rules of one’s financing supplied by the latest FHA. New Government Casing Administration try ruled because of the Department regarding Construction and you may Metropolitan Creativity (HUD). For this reason, its inevitable this particular ruling human body sets up the principles to own a home when it comes down to getting rejected or recognition. Your body FHA is in charge of making certain lenders but is not directly in capital all of them. Here, lenders (banks) gamble a crucial role in enabling our home refused or recognized.

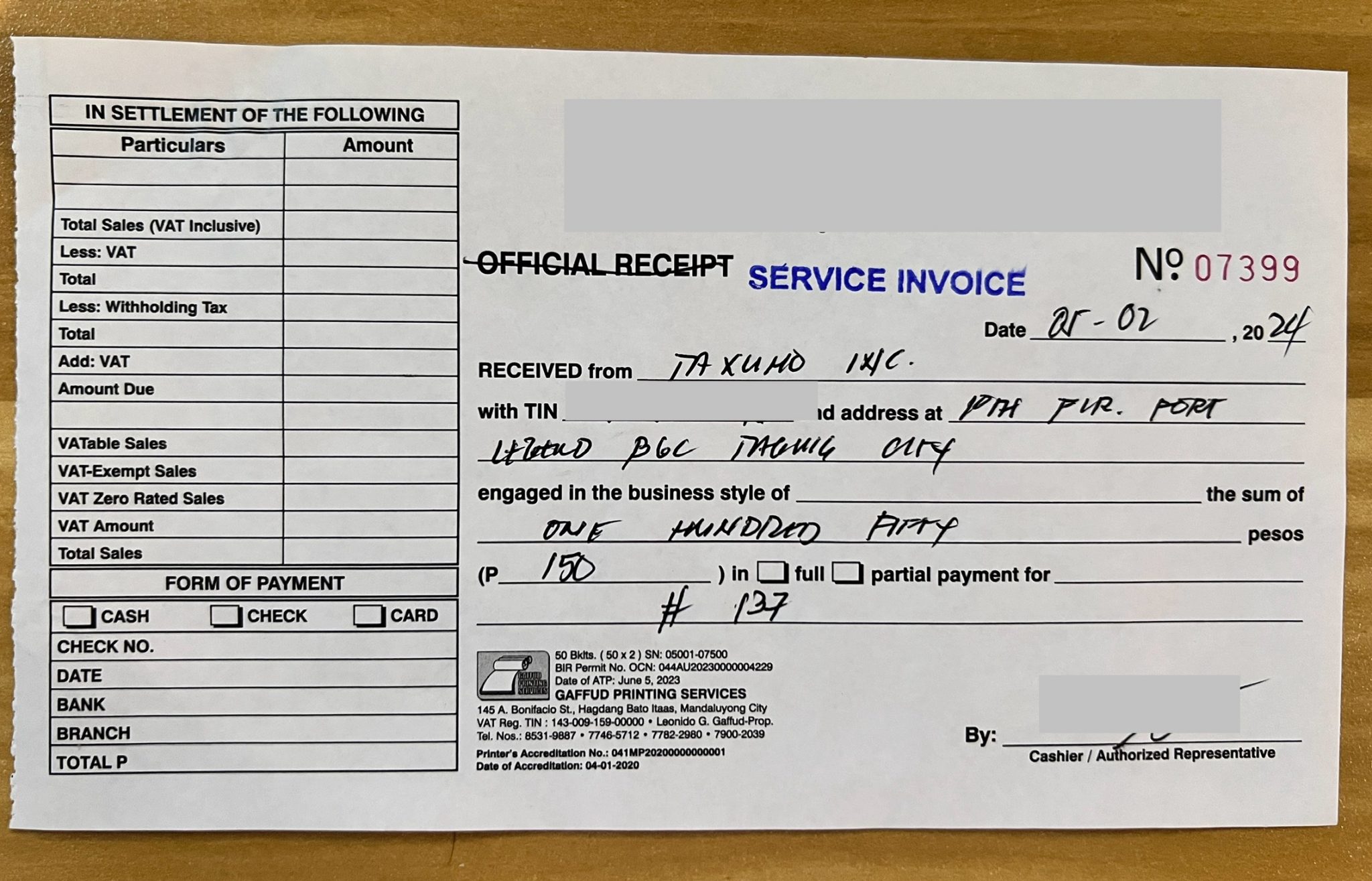

The fresh new FHA means their performing lenders to consider brand new assessment all about home inspections, having becoming done-by an FHA-accepted appraiser. The lenders, and their underwriting acceptance, work with behalf of the FHA, and this property suffices its set requirements getting insurance coverage. This insurance cover protects the financial institution when a loan borrower defaults at a later phase.

Mortgage Limitations

Any pricey household fails to qualify for an FHA loan getting obvious causes. The fresh ruling system (DHU) establishes loan constraints per year, and therefore disagree from the quantity of devices and you will venue. The FHA has its constraints so far as the borrowed funds matter can be involved. People costly house or apartment with plain old FHA down-payment off 3.5% will provide you with a loan amount surpassing the fresh new place restriction. Including, Bay area County provides the highest possible mortgage limits since it is one of a pricey costs town. It’s a threshold around $729,750 for one family home.

There, a house costs doing $800,000 and that’s incorporated with the very least deposit amount of $twenty-eight,000 having borrowers exactly https://paydayloancolorado.net/catherine/ who don’t be eligible for FHA. The borrowed funds matter stays high during the a massive price of $772,000. The new debtor will need to $43,000 so you’re able to qualify for property towards loan.

Condition

Your FHA foreclosed house, the newest FHA can be again build this type of property entitled to the loan. The fresh new FHA-insured house is the characteristics that have repairs only $5000. However, people non-insured homes away from FHA provides fix costs of greater than $5000. You might sell it thanks to HUD provided these types of do not be entitled to people the new FHA financing.

Lenders just take its finally phone call regarding the rejecting otherwise giving the latest financing for all the applicant. However, the brand new investigations away from good residence’s updates from the an appraiser stays an very important craft you to affects the decision out-of granting otherwise rejecting any mortgage. The lenders request this one inadequacies be repaired in advance of giving otherwise rejecting the fresh new money.

Such as, the lender may require a home that is required getting handled toward exposure of termites or any other wood-damaging bugs, generally if the appraiser denotes termite damage, which hampers the brand new architectural integrity of the property.

The sorts of Characteristics

Your property mortgage would be refuted if it does not satisfy this guidelines toward assets style of. By way of example, FHA funds for apartments is regarded as less than apartments built into the HUD-accepted cities otherwise complexes. You are able to discover such FHA-eligible complexes along the HUD’s portal.

Many of these buildings can certainly follow this new HUD standards for activities instance financial balance, responsibility insurance coverage and you may danger. The fresh new built house comply with specific specific norms. Instance, you’ll find a lot of forever fixed house more their foundation and you may get into the actual house tax components. All of these properties end up in it standards in the event that their framework date falls on the otherwise before fifteenth Summer 1976.

Achievement

FHA finance was realistic solutions for choosing a comprehensive assortment of functions. It has been a clinical choice for people with lowest credit results (less than 680 approximately). Which have have for example straight down rates and you will deposit requirements, FHA finance help make house-to shop for a practical choice. Yet ,, it’s got certain standards in order to satisfy. The aforementioned are a handful of factors one to deny the FHA loan; for individuals who still have questions, please call us.