It’s quite common degree you to organization loan providers across America has actually significantly tightened their qualifying criteria. But not, a lot of people are unaware of one to even in the event old-fashioned funds are extremely more strict, bodies finance have not done the same kind of change. The usa authorities keeps always was able a popular role within the the newest housing industry. Towards the whole benefit weakened, a lot more than ever before, government entities is wanting to meet up with the mandate to strengthen the available choices of as well as affordable houses for all Us citizens.

With respect to government-recognized loan activities, the fresh FHA and Va financing programs try by far the most widely used, but not, they are certainly not the only real government loan applications offered. FedHome Loan Centers focuses on capital all kinds of government mortgage and grant programs. Our very own Government Financing Gurus usually carry on with thus far with all of the various authorities software and maintain awareness of transform and you can improvements after they are put out. Have a tendency to skipped, but appear to required from the all of us is the USDA Guaranteed Loan. The latest USDA outlying financial try a new program that’s perhaps not supplied by every lenders. It is unique because it is the only real zero-down-payment system nevertheless offered to American customers together with the Va mortgage.

What’s a great USDA Mortgage?

The fresh new USDA Mortgage , just as the Virtual assistant financing program develop which have President Franklin D. Roosevelt. In 1935, through Exec Order 7027 created the Resettlement Government, whoever purpose were to move in destitute families, influenced by the Despair, fix areas enduring really serious surface erosion, and let growers that have financing to have equipment and you will belongings. When you look at the 1946, loans New London the brand new Resettlement Administration are immersed towards Ranch Safeguards Government and you may later on brand new Farmers Domestic Government in the 1946. The latest FmHA was subscribed from the congress inside 1946 to include funding for casing, organization, and you can neighborhood business for the outlying portion.

Today the united states Agencies of Agriculture carries on the new legacy deserted by FmHA, guaranteeing mortgage brokers for qualities into the rural parts. The new USDA has actually a loan portfolio regarding $86 mil, applying nearly $16 mil for the mortgage claims, system financing and you may offers.

An excellent USDA rural innovation home loan is actually an ensured financial financed because of the a medication USDA lender around specialized loan program administered from the All of us Department out-of Farming. The program’s name ‘s the USDA Rural Advancement Secured Houses Financing program. What exactly is one among an educated options that come with an excellent USDA loan was the no cash off, 100 percent resource alternative. It applications Ensure comes form the usa Government and handles the financial institution in case there are a buyer standard. For their guarantee, loan providers just who render these financing are prepared to forgive the brand new down-commission necessary for a home loan. The fresh new qualifying conditions having a great USDA Financial act like a keen FHA mortgage and are usually easier and you may forgiving than traditional financing software.

Such as for instance FHA and Virtual assistant loans, loan providers issuing new USDA mortgage is safe in case there is a property foreclosure by the federal government. In case of a default, the government usually take in the bulk of losing rather than the lender. This kind of authorities input helps take back resource, generate casing economical for reasonable to average money individuals and improves the overall housing supply.

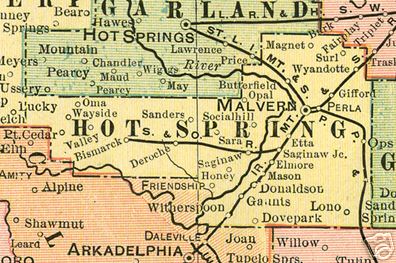

Having a USDA mortgage, and the borrower, the home also needs to satisfy certain requirements. The latest debtor have to totally document their capability to pay without surpassing 115 per cent of one’s median money towards the urban area. Along with the debtor certification, the home have to be based in an area that is designated while the outlying by USDA. New outlying designation are identified by postcode. All the Says features rural elements designated from the USDA. In some Says, the fresh new USDA provides actually designated whole counties since outlying and therefore all household where county perform be eligible for an excellent USDA mortgage.

Due to the fact name ways, an effective USDA financing is actually administered of the United states Service off Farming. not, you don’t have to individual an excellent cow to take advantageous asset of this excellent opportunity. Just like the intention of the system is for the main benefit of rural portion, of several consumers is shocked to determine exactly how many romantic-inside suburban communities meet the requirements.

An effective USDA mortgage is perfect for consumers who will be trying cash-within the on inexpensive costs on the borders away from significant metropolitan areas.

USDA loans was to possess thirty years with a low repaired speed. More glamorous function out-of a USDA financing is the fact no down payment needs. In fact, in addition to good Va financing, a beneficial USDA mortgage is the only remaining completely resource choice nonetheless being used on housing market now. To learn more about this useful program, label 877-432-5626 .

1st step of procedure is to try to get in touch with FedHome Loan Facilities and consult with a national Mortgage Expert by calling 877-432-5626 . Your loan manager will ensure you will get started off towards the right base. In order to get the most from your residence google search experience, it is vital to become prequalified. The loan administrator will assist you to see just how much home you really can afford, helping you to discover your entire solutions and working directly along with you even though you restrict your choices.

When you are in search of investigating even though a great USDA loan suits you, begin by contacting 877-432-5626 .

Exactly what are the USDA Home loan Standards?

- The house or property should be situated in a place that is designated given that outlying by the USDA (your own FedHome Mortgage Facilities Loan Officer will get out in the event the a great house is qualified)

- System can be acquired for sale exchange only (no money properties otherwise 2nd property)

- Readily available for step 1 st Time Consumer or Repeat Buyer (Consumer dont very own several other family within lifetime of get)

- Whole price (plus upfront MI) would be financed (100% resource, zero downpayment expected)

- The minimum credit score to own USDA acceptance is actually 620. The debtor should have a reasonably a good credit score background which have limited 30 day later money during the last 12 months. The lending company need to dictate repayment feasibility, using ratios from repayment (gross) income so you’re able to PITI also to complete household members personal debt.

- Customer income is limited so you’re able to a total of 115% of one’s area’s median income (contact a FedHome Mortgage Centers authorities financing pro to own facts to discover the income limitations for the city)

- W2 earnings or thinking-functioning is alright (earnings and employment must be fully documented)

- Present from Closing costs try greeting

- Seller or bank is also contribute around 2.75% of your transformation price toward closing costs

Start off

For more information regarding USDA construction funds or perhaps to sign up for get an effective USDA home loan on the internet; label 877-432-5626 now or complete the mode more than .