HELOCs are preferred getting financing higher sales, such as for instance building work projects. Listed below are four brilliant utilizing a beneficial HELOC:

- Put it to use getting issues. For those who have a beneficial HELOC, you are able to will have access to cash in case of an urgent debts, particularly a home or vehicle fix otherwise scientific bill.

- Build home improvements. If you are intending to your renovating your residence, an effective HELOC are a great way to loans your panels.

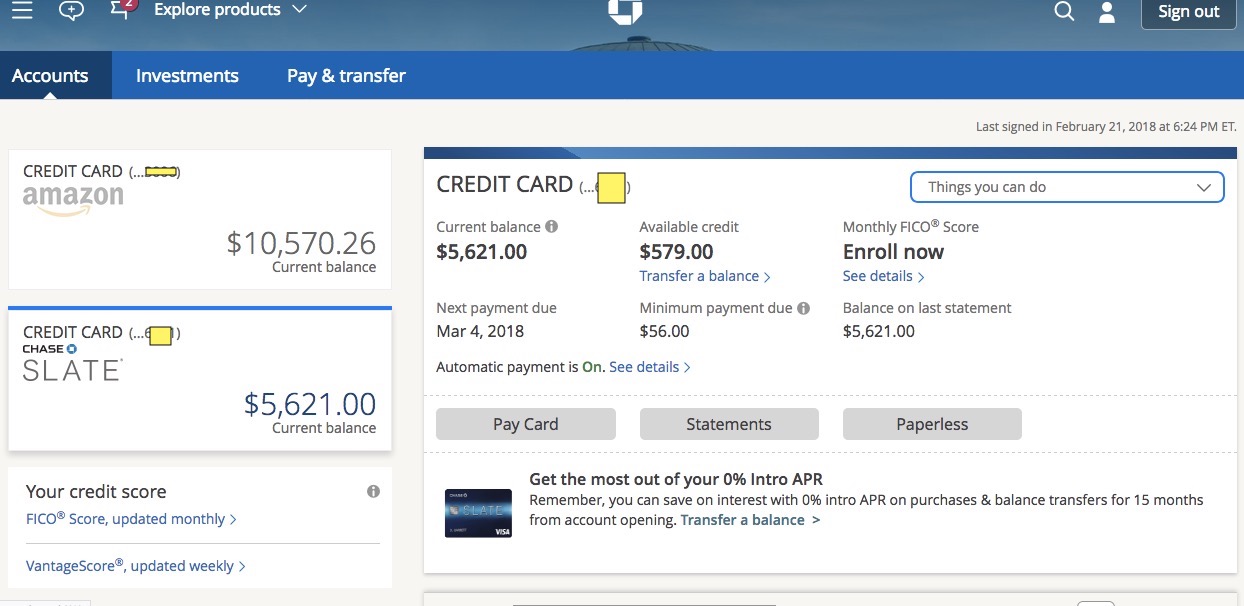

- Combine debt. Combining large-desire expenses such as for example credit debt towards the one percentage with good HELOC can help you save money and time throughout the long run whilst enabling you to repay your financial situation easier.

- Purchase your education. You need to use the fresh new guarantee of your home to cover their studies if you need to go back to college otherwise score professional studies.

Here is how to use Family Collateral to construct Riches

The equity when you look at the property is the single largest resource from most American home and can be studied in different an approach to increase one to family members’ economic balances and you will wide range.

Building collateral of your property is just one of the top suggests to increase your general money whilst still being gain benefit from the professionals of being a property manager. You could potentially create collateral if you are paying of their financial smaller than new payment plan, constantly spending more the minimum payments in your home loan payday loans Topstone, or by raising the worth of your house because of remodeling otherwise other developments.

Collateral Include-Vantage System

In lieu of and then make one monthly mortgage repayment, Equity Create-Vantage deducts half your own month-to-month mortgage payment from your own examining account the 2 weeks. Whilst it may sound insignificant initially, this moderate speed of your own costs can rather reduce the total cost of your home loan.

After you join a good bi-each week fee program in this way, you are able to pay twenty six costs out-of 50 % of your own monthly home loan. By the end of a-year, you might spend the money for equivalent of you to definitely a lot more payment per month you to myself decreases the dominating harmony of one’s financing. Such as for instance, toward good $2 hundred,000, 30-season mortgage having a beneficial 5% interest rate, you can save throughout the $34,000 for the appeal payments and you will pay the loan almost four decades eventually. Therefore, you are strengthening beneficial collateral smaller.

Methods for Just how to Power Domestic Guarantee

Before carefully deciding whether to pull out an effective HELOC otherwise house guarantee mortgage, it is vital to consider the advantages and you can possible drawbacks.

Just like any financing, their HELOC otherwise home guarantee financing will ultimately have to be paid down. Very, should you decide to the swinging once more soon, using up a lot more debt might not seem sensible. Any time you borrow money, it will effect your credit score. Very loan providers have a tendency to consult to look at your credit history when your apply for a home loan, which may or may not affect your credit rating based on many other activities within your record. A massive loan balance in your HELOC could also perception their offered borrowing.

Even in the event HELOCs aren’t right for individuals, of numerous property owners delight in the flexibleness they give you by allowing these to explore their house’s security to fund a variety of will cost you. People take out HELOCs since they’re an easily accessible means to locate even more financing having higher education, home improvements, and you can problems. Consider this: in the place of scrambling discover money in a crisis, would not your rather have a professional credit line you could potentially draw off any moment?

You to big brighten of good HELOC would be the fact costs are only needed towards the matter you obtain. If you don’t have an equilibrium due, you may not enjoys a repayment. Nevertheless line of credit will still be readily available if the and you may when it’s needed.