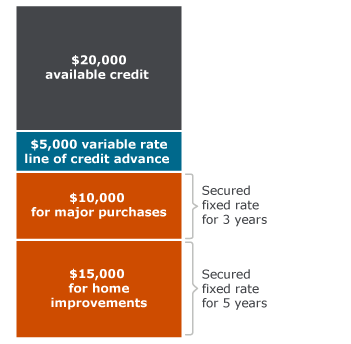

You can build the following demand fund:

Beneath the discount kind of notice percentage, the complete desire computed on tenor of your mortgage, (USD step 1,000), is actually subtracted in the affordable (USD ten,000) and just USD 9,100 was state-of-the-art.

Inside attract percentage means, the interest try calculated into the dominant of your own loan and you can instead of this new moderate. All the same, like the discount strategy, the interest is actually subtracted on principal in the course of initiation of your mortgage.

You have advanced Mr. Brian Williams a loan out of USD ten,100 under the system Short term loans For individuals within ten% notice to own annually.

Under the correct discount kind of attract percentage, the attention count inside the pure terminology isnt USD step 1,one hundred thousand however, below that. For the reason that the rate from ten% is not put on USD 10,100000 but on the genuine amount paid (derived of the program) that is USD .

4.2.sixteen Indicating the Maturity Particular

New Maturity Method of you really have given on the product is shown by default, regarding monitor. Yet not, you might transform it to one of your following the:

The fresh new Maturity Big date isnt repaired. The loan is liquidated when. It indicates the latest bargain try a request loan.

The loan was liquidated immediately after a particular chronilogical age of find. What amount of days of observe will be given on display screen

For a financial loan with a fixed Maturity, which day may either be delayed or state-of-the-art, through the Worthy of Dated Transform form.

In the event the Readiness Sorts of is fixed (that’s, new Maturity Time of your financing is famous in the event the loan try paid), indicate this new Readiness Date whenever going into the mortgage. Which date can be later compared to the Begin Time of equipment. In the event the device enjoys a basic Tenor, so it day are defaulted, according to research by the tenor together with Of Day of your price. If it day are changed an enthusiastic override are given when your shop the loan.

For a financial loan with Phone call or Notice type of readiness, the new Readiness Time will likely be inserted regarding the display screen immediately after they known. That it day can be afterwards as compared to Initiate Day of the equipment. You can discover the newest list and you will range from the big date.

Oracle Credit keeps an interior parameter Standard Payment end tenor’ to point the conclusion months to possess a great request financing commission on a monthly basis. Which tenor is utilized to get at the finish date to own calculation of accrual count (simply for Straight-line strategy form of) regarding progress kind of charge.

In the event that avoid time try handled, the computer facilitates that look after supply in order to identify rate revise times for a consult mortgage.

- Floating-Automobile

- Floating-Periodic-Auto

- Floating-Periodic-Guidelines

In lifetime cycle of your americash loans Demopolis loan bargain, you are permitted to modify the modify strategy simply for Floating-Occasional kind of demand financing.

You could explain the interest rate improve dates in a similar way since the laid out getting normal repaired maturity variety of fund. However, if if for example the latest inform dates is actually more than, you can take care of the the fresh modify schedules as deal amendment.

If for example the equipment enjoys a standard Tenor, so it day would be defaulted based on the tenor in addition to Off Go out of one’s deal. For individuals who change which day, you must promote an enthusiastic bypass after you shop the mortgage.

If you have given automobile liquidation to the mortgage, liquidation is carried out automatically thereon date. If guide liquidation has been given, you have to by hand liquidate the mortgage from Tips guide Liquidation function.

For a financial loan having Fixed Maturity Kind of, so it time may either feel expanded or produced backwards through the Really worth Old Alter form, as the financing could have been initiated.