When you yourself have zero credit otherwise a minimal credit history, it does search actually much harder discover options for borrowing money. While each and every bank and you can bank have different requirements, it can be simple for you to receive financing as opposed to a credit assessment.

Whether or not you need accessibility easy money on account of a monetary emergency, unexpected expenses, and other unanticipated activities, it does become even more exhausting if you don’t have founded borrowing from the bank otherwise your credit rating is leaner than you’d like it so you’re able to end up being Theodore bad credit payday loans. While most financial institutions and you will loan providers want a credit check ahead of you get that loan, there may be money options for you to definitely explore one to generally dont are a credit check prior to acceptance. Huntington has arrived so you can navigate some of the financing choice that could be on the market instead a credit score assessment. Just remember that , the lender is different, very consult with your financial to possess certain facts, programs, and requirements.

Could i Get an unsecured loan with no Credit View?

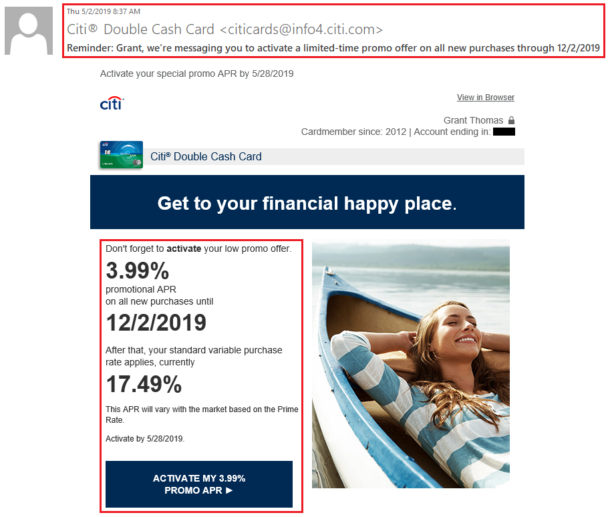

Extremely finance companies and you can loan providers wanted a credit check just before approval for the a personal bank loan. A credit score assessment usually comes with the FICO Rating, percentage record, current loans, income, or other items depending on the lender. To learn more about credit plus results, records, and, listed below are some the borrowing training point for much more facts.

A whole lot more conventional lenders usually generally speaking simply want to offer funds to help you individuals that have large credit scores minimizing risk situations. Good credit is frequently between 670-739, if you find yourself loan providers envision a rating of 740-799 become very good. Lower exposure facts tend to be virtually no loans, a reputation to the-date payments, a stable earnings, and more . Should your borrowing from the bank is leaner than loan providers normally imagine a good good rating, dont worry. You still have solutions with respect to bringing that loan. There are many loan providers who happen to be prepared to focus on consumers with smaller-than-best credit records.

How to get an unsecured loan without Credit

Based your financial activities, you may be capable take-out a small financing that have no credit score assessment. A few options that will be open to you are becoming a loan having a beneficial co-signer, bringing a protected charge card, otherwise taking right out an advance loan.

Loan with good Co-Signer

If you fail to qualify for financing your self as you may have no credit score, a reduced credit rating, or other chance things, financing that have good co-signer was an option for you. An excellent co-signer toward financing makes you play with its a good credit score score and you can borrowing records as the a make certain that you’ll pay straight back the borrowed funds and you may one attention otherwise charge. Normally, you are however only responsible for and also make all of the payments accurately and you can promptly. But not, both the debtor and also the co-signer usually are in charge legitimately your a fantastic debt otherwise defaults that may are present to your financing.

Taking right out financing that have a trusted friend or family member since the a co-signer would be a selection for your. However you must make sure your capable build all the payment, plus focus, timely. Because your co-signer is additionally responsible for the loan, any mistakes or later costs in your financing you may negatively impression each of the credit scores down the road.

Protected Mastercard

If you’re looking getting a way to borrow small amounts of cash without a credit assessment, a secured bank card might possibly be a simple solution for your requirements. Shielded handmade cards normally wanted a finances put which you shell out initial, and that functions as their borrowing limit. If you make costs promptly, you’ll always get put into complete and perhaps assist in improving your credit rating. But not, their entry to finance is normally restricted to the brand new deposit number you’re able to spend. A protected bank card may only be an option for folks who wanted a small amount of credit available instantly, as opposed to a lump sum loan.