Eventually, new HomeSteps system is advisable if you’re within the following claims: Alabama, Florida, Georgia, Illinois, Kentucky, New york, South carolina, Tennessee, Colorado, and you will Virginia. This method, and this Freddie Mac computer facilitates, simply need 5-10% down and won’t want financial insurance rates. You’ll want to Wisconsin title loan come across good HomeSteps eligible property to use that it system.

Disadvantages of getting a foreclosed family

If you’re purchasing good foreclosed home can offer a special chance, it’s critical to see the potential downsides so you’re able to generate the best choice and confidently move on.

Lengthy techniques with additional papers

Foreclosures present a lot of problem, in accordance with those complexities will come a lot more documents and processes. When you are banking companies was wanting to offer the qualities, its techniques and you will reaction times can certainly be hard.

Home condition questions

In the place of other sorts of homes, foreclosed belongings are sold as is. The consumer is in charge of any damage, repairs, or repair and this can be needed into home. This may involve solutions that will not immediately noticeable. When it comes to a good foreclosed property, the vendor make zero upgrades or improvements. Yet not, suppliers have an obligation to disclose the current presence of head painting. In some places, vendors may be needed to disclose past architectural faults, a history of flood, otherwise infestation.

Since these land are offered as well as, you will want to predict them to you want fixes and status. With respect to the domestic under consideration, these solutions is high priced, especially if he’s unexpected. It’s strongly suggested that you done a house inspection during the home buying strategy to know what solutions might be required.

If you find yourself uncommon, you can also experience vandalism, particularly if the possessions has been bare for an excessive period. In some instances, past residents years otherwise dump items of well worth from the family.

Battle

A house people and you can top-notch house flippers is actually common and well-qualified in to shop for foreclosed home. Obtained generated buying foreclosed attributes its whole business, and you will anticipate these to be discreet consumers. Foreclosed belongings most abundant in possibility can sometimes attract numerous bidders. The group to have foreclosed land has only improved recently due to the foreclosures moratorium given as a result to your COVID-19 pandemic.

Benefits of getting an excellent foreclosed house

Knowing the possibility dangers of buying good foreclosed household, you might consider any inquiries against the novel capital opportunity that it kind of pick has the benefit of.

Price rates

The largest advantage of purchasing good foreclosed home is the fresh new speed. Foreclosed property are usually marketed at under most other comparable house in identical area. Getting pre-foreclosure or small conversion process, the proprietor features short time to sell the property. They’re usually willing to deal with less than the fresh home’s market value. To other brand of foreclosure, it’s useful to remember that finance companies, local law enforcement, and you can bodies businesses are not in the industry off selling genuine house. It has been in their welfare to offer people a house it to get efficiently and quickly.

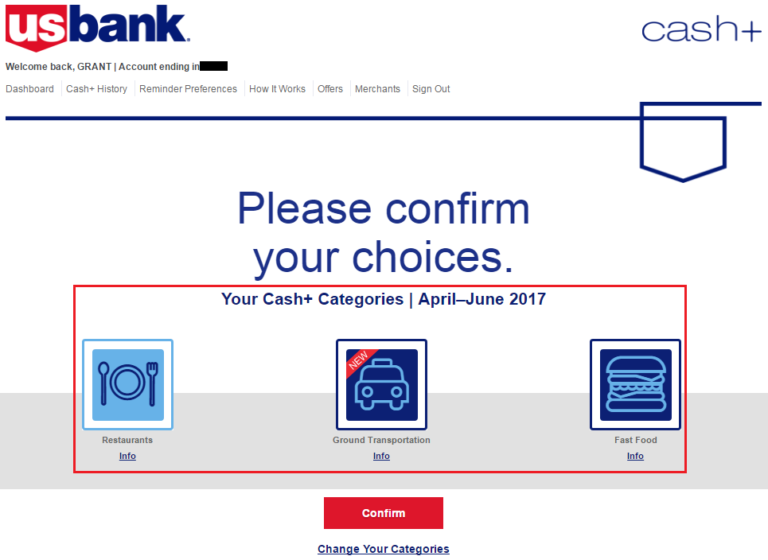

Oftentimes, you will be provided a lot more bonuses beyond rate. Some sellers can offer less down payment, straight down interest levels, and you may a decrease or removal of assessment fees or settlement costs.

Capital ventures

To order foreclosed belongings shall be a smart way away from getting straight down-rates real estate and you may leading to your investment profile. If you intend in order to book the home and you have the fresh financing while making any necessary fixes or standing, you are able to present an income-positive rental property.