Whenever a happy veteran called James and his companion, Emma, set-out toward go to create its fantasy household, it realized one securing best investment is actually crucial. It explored a variety of Va construction loan lenders, knowing that such authoritative money, backed by the fresh U.S. Agencies out of Experts Activities, offered unrivaled financing pros.

Throughout the lack of private financial insurance rates towards prospect of no downpayment, James and Emma was conscious that it station could save them notably fundamentally.

However, while they delved toward process, they encountered feedback and information from all the information, the recommending which an educated Virtual assistant design loan companies might be. For each and every recommendation is actually convincing yet personal; it became evident you to choosing the ‘best’ is actually smaller on universal recognition and much more on whom best met their unique need and you will factors.

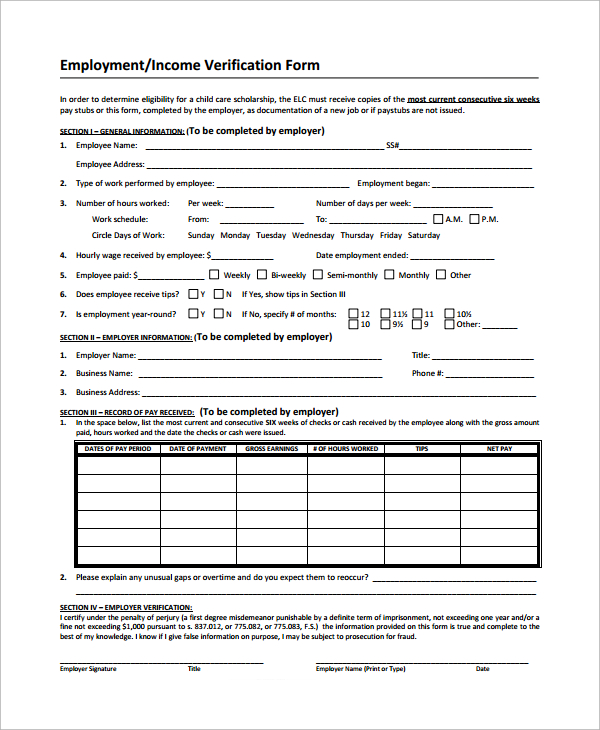

Image of blueprints and you may writing gadgets usually in the performing agreements to possess home-building, like those used whenever obtaining an effective Va Structure mortgage.

Trick Takeaways

Va design funds render extreme professionals, including no significance of individual home loan insurance policies together with likelihood of zero deposit.

Focused lookup and you can research are very important in choosing a lender you to aligns towards borrower’s financial needs and you can endeavor scope.

The definition of new ‘best’ Va framework mortgage bank are inherently personal and you will may vary in line with the borrower’s book items.

Why would I envision a good Va Framework Mortgage these days?

Amidst the causes regarding the current monetary landscape, good Va design loan is provided as the a very good option for pros looking to create their brand name-this new land regarding surface right up. This particular mortgage equipment not just talks about the price of strengthening your house but may and additionally cater to the acquisition of your own belongings they sits up on. Into benefits such finance offer additionally the evolving efficiencies inside the the newest financing techniques, there are lots of vital factors for those who qualify for that it mortgage kind of considering beneath the Va mortgage system.

As well, because there are highest loan wide variety acceptance underneath the Va financing program, borrowers features better liberty than exists lower than a traditional build loan system. In addition to, because the industry could have been very tough, Pros who had been thinking of buying a property playing with a great Va pick mortgage are weighing its option of building the new.

Of many have discovered a loan provider that gives Va construction generally speaking offers almost every other book items like Va recovery finance, when you could be entitled to the greater chance and a lot more tough structure program, you probably tend to be eligible for a beneficial ree time off that credit history.

A recently no credit check loans Mcmullen, AL complete You to and you will step 1/2 facts craftsman build domestic having fun with an effective Va Structure Loan system which have a nationwide Financial Lender

Can you currently individual home, otherwise have you been still searching?

Whether you have the best spot otherwise you are on the fresh look for they, the flexibleness off good Virtual assistant structure mortgage could work on the advantage. That have choices to is land order within the loan, experts are able to find tall well worth and you may convenience contained in this all of the-encompassing financing method.

Anyone who has currently possessed belongings for more than half a year can use any gathered collateral towards deposit of one’s mortgage. That it holds true for really structure software however for everybody loan providers. Although not, the newest Va will not give a stand-alone homes mortgage, letting you choose the property then go back ages after to the structure part. It ought to be rolling to the a classic, one-day close or two-day personal structure mortgage.

These financing can help you secure your ideal spot out of home, the ideal creator you wish to explore, and permanent loan financing, everything in one loan otherwise a couple.