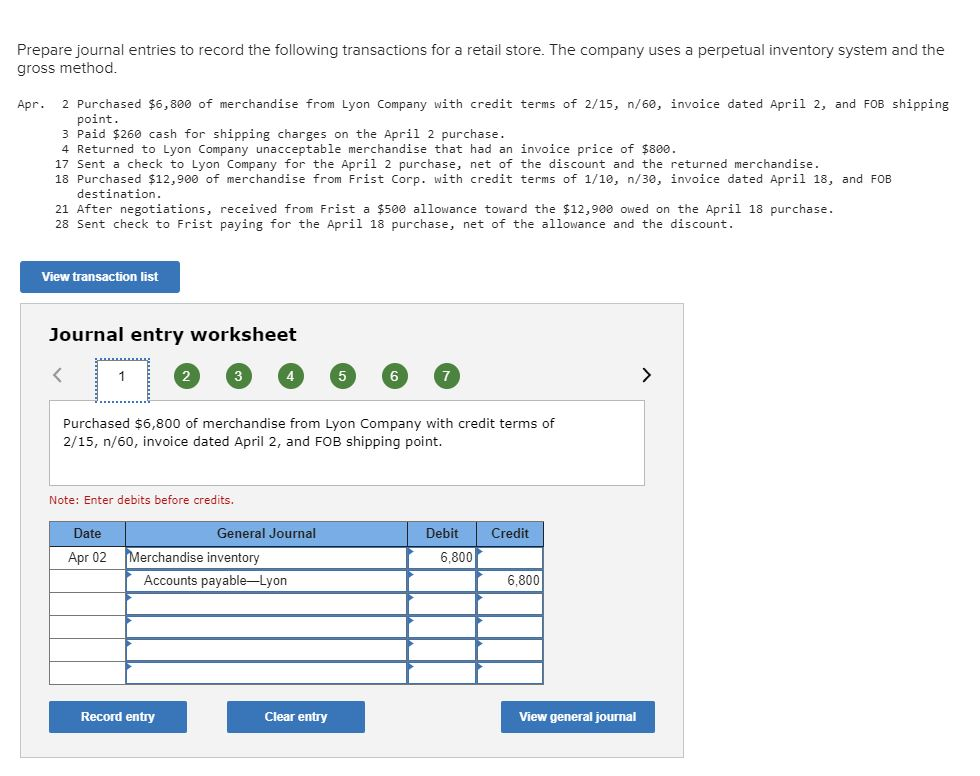

The fresh new FHA loan system can make owning a home more realistic for almost all homebuyers. While this shouldn’t be experienced an enthusiastic FHA financial qualification calculator, household cost out-of an excellent lender’s standpoint boasts a good borrower’s loans-to-earnings (DTI) proportion. With respect to the homebuyer’s credit score and other features, FHA loans can sometimes be recognized with a DTI since the highest since the fifty%. The FHA affordability calculator makes you have a look at a variety of projected home values playing with more DTI ratios centered on your revenue and you may monthly loans costs.

Upgrading the fresh new DTI accustomed assess the latest projected family finances commonly alter the projected monthly payment and you may recalculate the desired FHA down fee. FHA financing requirements enjoys the absolute minimum deposit regarding 3.5% of one’s residence’s price. Having the ability to spend the money for FHA down payment is as crucial due to the fact appointment this new month-to-month FHA payment duty. The outcomes found indicate an effective 3.5% downpayment. In order to test out huge down costs in addition to their effect on monthly FHA mortgage payments, use the FHA finance calculator.

FHA financing value must account fully for brand new FHA mortgage insurance coverage premium. FHA money are available to so many homebuyers once the FHA covers the mortgage financial in the event of standard. Thus, a portion of the FHA loan payment would go to insuring brand new mortgage. It home loan premium (MIP) is notably effect affordability. FHA MIP towards the a good $250,000 house is around $170 30 days. Based your earnings, FHA MIP you are going to affect the DTI enough to believe a diminished cost.

Just what will be my personal DTI become?

Every person, family unit members, and you can homebuyer is different. There’s absolutely no DTI that works well for all, other than to state that down is advisable. Anyone, family members, and you can homebuyer is different. There’s absolutely no DTI that works for everybody, besides to declare that down is advisable. While not set in stone, the fresh roadmap founded by the FHA is a good kick off point.

29 refers to your casing ratio, which is only your overall proposed month-to-month house fee (dominant + attention + FHA MIP + possessions fees + home insurance) along with month-to-month HOA charge divided by your disgusting monthly money. Which have a property ratio (lenders name which their front-prevent proportion) away from lower than 31% isnt necessary, but it is a benchmark to consider whenever determining your spending budget.

This new 43 in the will be your DTI (lenders label so it back-end) ratio. It is everything included in the 29% along with your full monthly loans repayments. The more obligations you have the large this new pit between your property ratio and DTI. With front-prevent and you will straight back-avoid percentages which can be comparable form you may have treated the debt well.

When considering their DTI, it is very important see your financial updates and not play with a company DTI contour. A massive friends having thousands of dollars out-of month-to-month childcare costs is almost certainly not stretched that have a beneficial thirty-five% DTI mortgage repayment, while you are a single individual way of living a moderate lives can get easily be capable of handling one to on forty%. The payment and you will domestic finances determined making use of Washington payday loans the FHA cost calculator will likely be made use of since techniques. Take into account the over image, which has the DTI, existence, monthly bills, and you will everything else, when choosing your house finances.

FHA Mortgage Prices & Cost

FHA financial cost will always be usually reasonable, but what do that mean having FHA homebuyers? The rate to your a home loan really influences the payment per month. The better the rate, the greater the loan fee. However, the rate will not change the percentage and you can value as often in general might think. Instance, a basic 29-year home loan getting $100,000 having good 4% interest keeps a main along with interest fee of $. Reducing the price to 3.875% changes the brand new percentage to $. That’s $eight.19 four weeks. When shopping to have the lowest financial rates is essential, small movement in interest rates will get a reduced effect on FHA loan affordability.

Will there be an FHA mortgage restrict?

FHA loan constraints are very different according to and that state and you will condition you is to purchase. Most counties nationwide make use of the FHA base financing limit to select the restrict FHA loan money number. A house rate above the state loan restrict means a more impressive downpayment than the lowest step three.5%.There are places where a home philosophy is high, and you may FHA makes up these types of counties of the improving the FHA financial restrict. Knowing the FHA restrict where you’re appearing will save you big date and money. If the funds exceeds what FHA it allows when you look at the good offered town, you’re going to have to imagine a conventional mortgage.