Turbotax Self-employed. Every Deduction Found. Every Dollar You Deserve. Start For Free.

You pay for something in one accounting period but don’t use it right away. For example, insurance Accrual Accounting vs Cash Basis Accounting Difference is often a prepaid expense because you pay up front and use it over a period of time.

Difference Between Cash Basis And Accrual

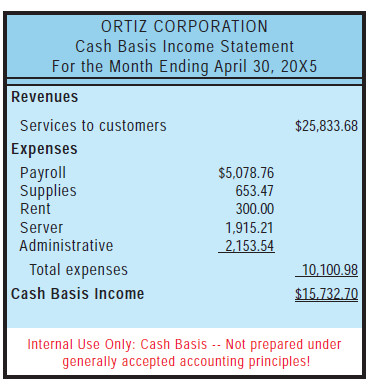

An investor might conclude the company is making a profit when, in reality, the company is losing money. It gives you a daily record of your business’ financial status. Cash basis accounting gives you a day-to-day snapshot of where you’re at financially. As a result, if you don’t have careful bookkeeping practices, the accrual-based accounting method could be financially devastating for a small business owner.

This means that if your business were to grow, its accounting method would not need to change. The Generally Accepted Accounting Principles, or GAAP, are the standard framework of rules and guidelines that accountants must adhere to when preparing a business’s financial statements in the United States.

Accrued Expenses Vs. Accounts Payable

Once a business chooses to use a specific accounting method, it should continue using it on a go-forward basis. By doing so, financial statements prepared in multiple periods can be reliably compared. With the accrual method of account, individuals report income for the specific https://personal-accounting.org/ time period in which it is earned rather than when it was received. It is most efficient to initially record most accruals as reversing entries. By doing so, the accounting software in which they are entered will automatically cancel them in the following reporting period.

The company will recognize the commission as an expense in its current income statement, even though the salesperson will actually get paid at the end of the following week in the next accounting period. The commission is also an accrued liability on the balance sheet for the delivery period, but not for the next period when the commission (cash) is paid out to the salesperson.

Disadvantages Of Accrual Accounting

What is accrual and its journal entry?

An accrual is a journal entry that is used to recognize revenues and expenses that have been earned or consumed, respectively, and for which the related cash amounts have not yet been received or paid out. It is most efficient to initially record most accruals as reversing entries.

For example, a company delivers a product to a customer who will pay for it 30 days later in the next fiscal year, which starts a week after the delivery. The company recognizes the proceeds as a revenue in its current income statement still for the fiscal year of the delivery, even though it will not get paid until the following accounting period. The proceeds are also an accrued income (asset) http://evalom.com/what-is-an-immediate-annuity-00058416.html on the balance sheet for the delivery fiscal year, but not for the next fiscal year when cash is received. Difficulty is one huge drawback of accrual basis accounting, where rules in the recognition of revenue and expenses can be very complicated. Now, if you want to fully and record transactions in your small business in accordance with GAAP, you should seek the help of an accountant.

When you started your business, you might have chosen to use cash-basis accounting. This method is a given for a large company, but for a small one, it may not be that beneficial. To determine whether accrual basis accounting is appropriate for your business Accrual Accounting vs Cash Basis Accounting Difference or not, it is best to understand the advantages and disadvantages that come with it. “Accrual is necessary in some industries, but it adds additional complexity, and for small business does not add much clarity to the financial statements or tax returns.”

- In contrast to the cash method, accrual basis accounting entails recording revenue once an invoice is made and recording expenses once you’re charged.

- This means that you make a record of income even before it reaches your bank account, and you note deductions for bill payments and the like before they’re paid.

- The cash method is used by many sole proprietors and businesses with no inventory.

- The cash method is simple in that the business’s books are kept based on the actual flow of cash in and out of the business.

The 2019 financial statements need to reflect the bonus expense earned by employees in 2019 as well as the bonus liability the company plans to pay out. Therefore, prior to issuing the 2019 financial statements, an adjusting journal entry records this accrual with a debit to an expense account and a credit to a liability account. Once the payment has been made in the new year, the liability account will be decreased through a debit, and the cash account will be reduced through a credit. The expenses related to revenue should be recognized in the same period in which the revenue was recognized. Similarly, a salesperson, who sold the product, earned a commission at the moment of sale (or delivery).

Understanding Accruals

Use the following approach to calculate income and expenses for your business using the accrual accounting method. Accrued expense is a liability whose timing or amount is uncertain by virtue of the fact that an invoice has not yet been received.

Business

The uncertainty of the accrued expense is not significant enough to qualify it as a provision. An accrual is a journal entry that is used to recognize revenues and expenses that have been earned or consumed, respectively, and for which the related cash amounts have not yet been received or paid out. Accruals are needed to ensure that all revenues and expenses are recognized within the correct reporting period, irrespective of the timing of the related cash flows. Without accruals, the amount of revenue, expense, and profit or loss in a period will not necessarily reflect the actual level of economic activity within a business.

Likewise, cash accounting only records your expenses when money leaves your account to pay expenses to suppliers, vendors, and other third parties. In other words, if you have a small gift card and stationery business that purchased paper supplies on credit in June, but didn’t actually pay the bill until July, you would record those supplies as a July expense. We go over cash basis Accrual Accounting vs Cash Basis Accounting Difference accounting and accrual basis accounting so you know the pros and cons of each method and which is best use for your small business accounting. They may base big financial decisions and things like loan applications on accrual accounting but use cash-basis accounting to simplify some elements of their tax. Speak to an accountant or tax professional to find out what applies to you.

Accrual (accumulation) of something is, in finance, the adding together of interest or different investments over a period of time. It holds specific meanings in accounting, where it can refer to accounts on a balance sheet that represent liabilities and non-cash-based assets used in accrual-based accounting. These types of accounts include, among others, accounts payable, accounts receivable, goodwill, deferred tax liability and future interest expense. They are temporary entries used to adjust your books between accounting periods.

Which accounting method do you prefer—cash basis or accrual? Patriot’s online accounting software offers both cash basis and accrual functions, so you can easily implement it into your bookkeeping processes no matter what method you use. AcountDebitCreditExpenses300Accrued Expenses Accrual Accounting vs Cash Basis Accounting Difference Payable300Total300300The cash to accrual conversion entry fixes the accrued expenses payable account. The entry also increases the expense account to show the total expenses for the period. Prepaid expenses are cash payments you made that relate to assets you haven’t used up yet.