Domestic appraisal

Essentially, the lending company would like to include the newest resource he is and also make. So they really get a keen appraiser to choose the property’s correct markets worth considering most recent a house conditions. Like that, should your worth is actually lower than the loan count, he has a chance to create adjustments for the mortgage versus losing hardly any money.

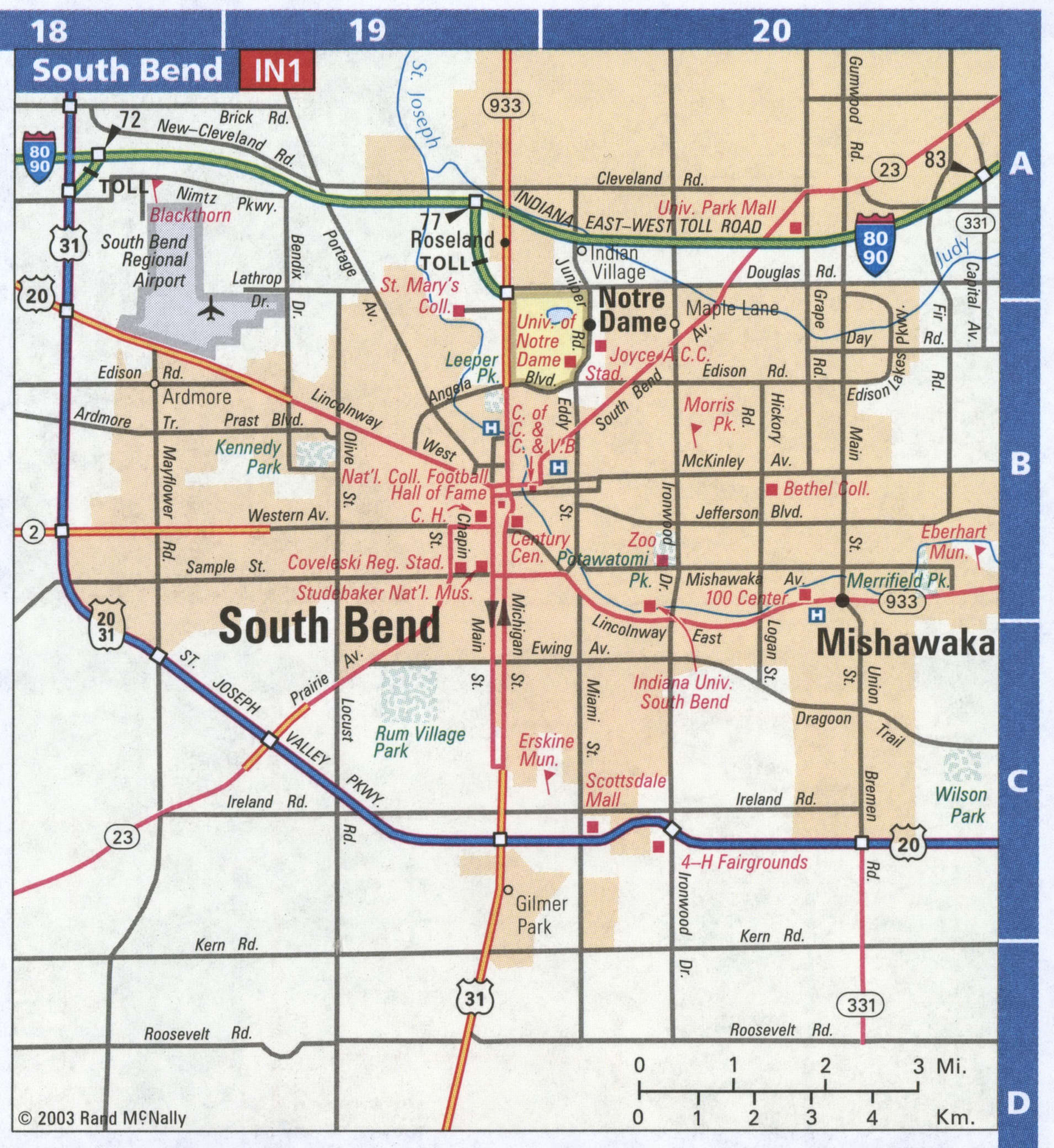

It doesn’t want far engagement from you (because the a borrower). The fresh new appraiser look during the latest comps in your community, in which he or she’ll check out the household we need to get otherwise re-finance.

This method brings an entire-picture look at just what home values are like in the region, not simply the credit possessions. In addition, it says to the brand new appraiser, bank, and more than notably you even though your home is a good investment.

Domestic review

A review is actually an important step up our home get process, since it notification buyers out-of what may need focus before signing a binding agreement. Throughout the property examination, an authorized inspector monitors the newest performance of the home’s roof, driveway, basis, creating, electricity, Hvac, and plumbing work.

Inspections aren’t requisite from inside the refinance processes, so we would not score past an acceptable limit to your what you on it. Yet not, if you’re looking buying a property, i strongly recommend you’re taking the amount of time to learn its characteristics best. You’re sure to acquire remedies for your home review questions when you realize our article – Inspection reports: How they Performs and What to Pick.

Securing your own interest

Now, this is a big step up the borrowed funds procedure, and it is among the many finest concerns that consumers query – whenever can i lock my interest rate? One address, of course, may vary centered on your own timeline along with your economic requires. But, i possess some suggestions in order to create an educated choice.

Really home loan applications is accomplished within this two months, thus these lock attacks are often enough having individuals but can indicate higher settlement costs.*

If you possibly could establish your processing and closing processes would be finished in monthly, think securing their rate having a month (while pricing commonly swinging much).

Mortgage rates can change everyday, either multiple times a day; if have a peek here you would like what you are cited, it could be really worth delivering it and you will locking inside.

Not so great news and you will uncertainty are good for pricing, so if the brand new savings begins to search crappy – you may want to wait it out a little bit.

Some loan providers offer a home loan rate secure drift off, that enables individuals a single-big date opportunity to exchange its latest rate having a reduced rates, incase pricing provides dropped.

Your own financial representative will provide tips about when you should lock, but it’s among those conclusion you will have to make your self. Although you ble and view how lowest you might go, interest rates was unpredictable and can increase any moment. It may not be value putting your loan at risk. Contemplate, your pre-approval is based on a certain price, and you can closing costs have been quoted so you’re able to fall into line thereupon speed. For many who lock to your anything high as you waited a long time, you may be thinking about a very high priced financing. Can you afford they?

Preferred underwriting degree and you can requirements

Given that we’ve got touched into price tresses, appraisals, and monitors, let us return to the fresh new strategies very all of the debtor skills during our home mortgage procedure. 2nd up just after running is actually underwriting. This is where the lender usually look at the qualification, confirm all the information you given, to discover while you are approved otherwise refused. It is a highly thorough phase, and it can include you shedding with the conditional approval, in which you’ll need to outline alot more files.