What Are Accrued Expenses On A Balance Sheet?

It provides an overview of cash owed and credit given, and allows a business to view upcoming income and expenses in the following fiscal period. Accruals and deferrals are the basis of the accrual method of accounting, the preferred method by generally accepted accounting principles .

A company that incurs an expense that it is yet to pay for will recognize the business expense on the day the expense arises. Under the accrual method of accounting, the company receiving goods or services on credit must report Accruals concept: AccountingTools the liability no later than the date they were received. The accrued expense will be recorded as an account payable under the current liabilities section of the balance sheet, and also as an expense in the income statement.

What Are The Main Types Of Assets?

Using the accrual method, an accountant makes adjustments for revenue that has been earned but is not yet recorded in the general ledger and expenses that have been incurred but are also not yet recorded. The accruals are made via adjusting journal entries at the end of each accounting period, so the reported financial statements can be inclusive of these amounts.

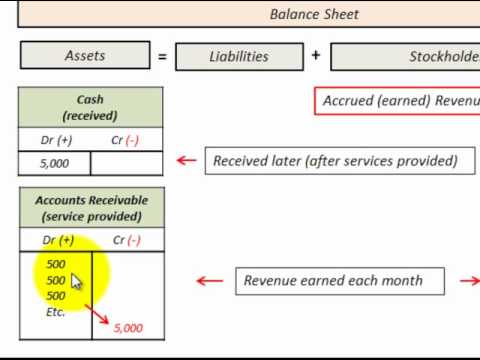

The sale is booked to an account known as accounts receivable, found in the current assets section of the balance sheet. For example, consider a consulting company that provides a $5,000 service to a client on Oct. 30.

What are the 3 accounting rules?

The Generally Accepted Accounting Principles in the US (US GAAP) refer to the accounting rules used in United States to organize, present, and report financial statements for an assortment of entities which include privately held and publicly traded companies, non-profit organizations, and governments.

Accrual Accounting Vs. Cash Basis Accounting

The latter approach will not result in financial statements that can be audited. For example, a company with a bond will accrue interest expense on its monthly financial statements, although interest on bonds is typically paid semi-annually. The interest expense recorded in an adjusting journal entry will be the amount that has accrued as of the financial statement date. A corresponding interest liability will be recorded on the balance sheet.

Accrual Accounting

And while it’s true that accrual accounting requires more work, technology can do most of the heavy lifting for you. You can set up accounting software to read your bills and enter the numbers straight into your expenses on Accruals concept: AccountingTools an accrual basis. It will also record your invoices as income as you raise them. And if you run a hybrid accounting system, smart software will allow you to switch between cash basis and accrual basis whenever you need.

- The accrued expense will be recorded as an account payable under the current liabilities section of the balance sheet, and also as an expense in the income statement.

- Under the accrual method of accounting, the company receiving goods or services on credit must report the liability no later than the date they were received.

- A company that incurs an expense that it is yet to pay for will recognize the business expense on the day the expense arises.

- This is called the matching principle and the accrual method of accounting.

The upside is that the accrual basis gives a more realistic idea of income and expenses during a period of time, therefore providing a long-term picture of the business that cash accounting can’t provide. Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned, regardless of when the money is actually received or paid.

Popular Concepts Of Accounting (10 Concepts)

For example, you would record revenue when a project is complete, rather than when you get paid. The cash basis of accounting recognizes https://personal-accounting.org/ revenues when cash is received, and expenses when they are paid. This method does not recognize accounts receivable or accounts payable.

The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your accounts. Cash accounting recognizes revenue and expenses only when money changes hands, but accrual accounting https://personal-accounting.org/accruals-concept-accountingtools/ recognizes revenue when it’s earned, and expenses when they’re billed . If you record an accrual for revenue that you have not yet billed, then you are crediting the revenue account and debiting an unbilled revenue account.

The unbilled revenue account should appear in the current assets portion of the balance sheet. Thus, the offsets to accruals in the income statement can appear as either assets or liabilities in the balance sheet.

Instead, it records transactions only when it either pays out or receives cash. The cash basis yields financial statements that are noticeably different from those created under the accrual Accruals concept: AccountingTools basis, since timing delays in the flow of cash can alter reported results. For example, a company could avoid recognizing expenses simply by delaying its payments to suppliers.

The concept of accruals also applies in Generally Accepted Accounting Principles and plays a crucial role in accrual accounting. Under this method of accounting, earnings and expenses are recorded at the time of the transaction, regardless of whether or not cash flows have been received Accruals concept: AccountingTools or dispensed. By doing this, a company can assess its financial position by factoring in the amount of money that it expects to take in rather than the money that it has received as of yet. The use of accrual accounts greatly improves the quality of information on financial statements.

The Difference Between Accrued Expenses And Accounts Payable

Alternatively, a business could pay bills early in order to recognize expenses sooner, thereby reducing its short-term income tax liability. Because the company actually incurred 12 months’ worth of salary expenses, an adjusting journal entry is recorded at the end of the accounting period for the last month’s expense. The adjusting entry will be dated December 31 and will have a debit to the salary expenses account on the income statement and a credit to the salaries payable account on the balance sheet. Accrued expenses are expenses a company accounts for when they happen, as opposed to when they are actually invoiced or paid for. An accrual method allows a company’s financial statements, such as the balance sheet and income statement, to be more accurate.

In essence, the accrual entry will allow this expense to be reflected in the financial statements. This is the concept that accounting transactions should be recorded in the accounting periods when they actually occur, rather than in the periods when there are cash flows associated with them.